They say that pessimists win at life because they’re either always right or they’re pleasantly surprised. Pessimism isn’t doing Super Micro (NASDAQ:SMCI) any favors, however, as it’s down around 8% in Monday afternoon’s trading. Why? Because it’s turning pessimistic on its own earnings report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Only recently, Super Micro’s expected revenue at the midpoint was $1.47 billion for the quarter. Earlier Monday, Super Micro turned that around, revealing that it would realize only $1.28 billion in revenue. The company blamed its supply chain for the troubles, particularly those involved in building products that would be part of wholly new product lines. Worse yet, the supply chain hiccup comes at a time when there was a “record backlog” in those new product lines. The demand was there, but thanks to the supply issues, Super Micro simply couldn’t capitalize on that fertile ground.

Wedbush’s Matt Bryson also offered some commentary, suggesting that Nvidia (NASDAQ:NVDA) might have had a hand in Super Micro’s troubles. The problem here stems from a lack of H100 graphics processors from Nvidia. The loss of those processors, among other things, contribute to what Bryson called “unsustainably high” sales growth forecasts.

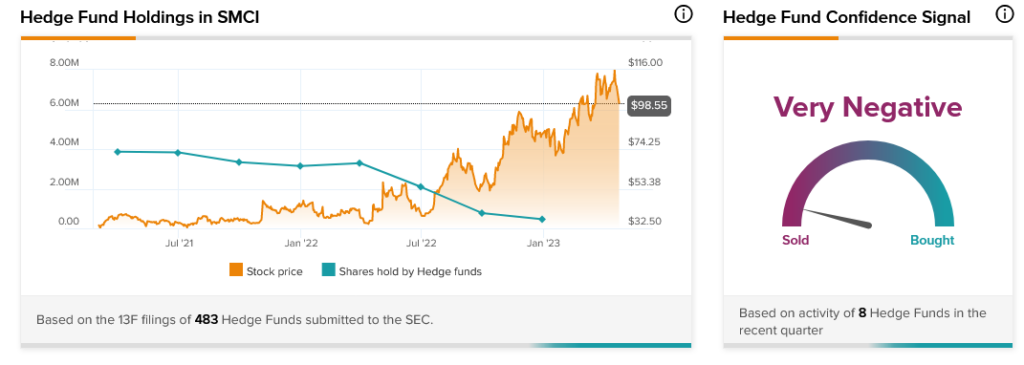

If analysts are divisive over the nature of Super Micro, hedge funds are much more committed…negatively, that is. Currently, hedge fund consensus about Super Micro stock is Very Negative, with funds divesting another 314,700 shares in just the last quarter. Worse, this is the third consecutive quarter that hedge funds have sold off Super Micro stocks.