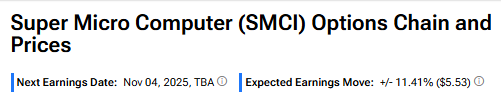

Super Micro Computer (SMCI) is set to report its fiscal Q1 earnings today, November 4, and options traders are expecting volatility. Based on recent options activity, the market is pricing in a potential 11.5% swing in SMCI stock, in either direction, following the release.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That is quite a large move for Super Micro, a key player in the AI hardware boom. SMCI’s long-term average post-earnings move is -3.39%, which reflects a decline.

What to Watch in the Report

In SMCI’s upcoming report, investors will likely be watching for commentary on the timing of its $12 billion design win backlog and progress toward its ambitious full-year revenue guidance of at least $33 billion.

Also, traders will keep an eye on the company’s gross margins to see if they remain steady or face further pressure due to product mix or rising competition. Management’s commentary on margin trends in the upcoming quarters will be in focus.

Lastly, investors are watching for updates about the rollout of Super Micro’s new liquid-cooled systems and upgraded chips from Nvidia (NVDA) and AMD (AMD). Slowing demand or rising competition in the AI server space could trigger volatility in the stock.

Analysts’ Expectations from SMCI’s Q1 Results

Wall Street is expecting SMCI to report earnings of $0.38 per share, down from $0.75 in the same period last year. Also, analysts project revenues of $5.83 billion, compared with $5.94 billion in the year-ago quarter.

It must be noted that last month, the company disclosed preliminary Q1 revenue of about $5 billion, below its initial $6 to $7 billion guidance and analysts’ consensus estimates.

Is SMCI a Good Stock to Buy?

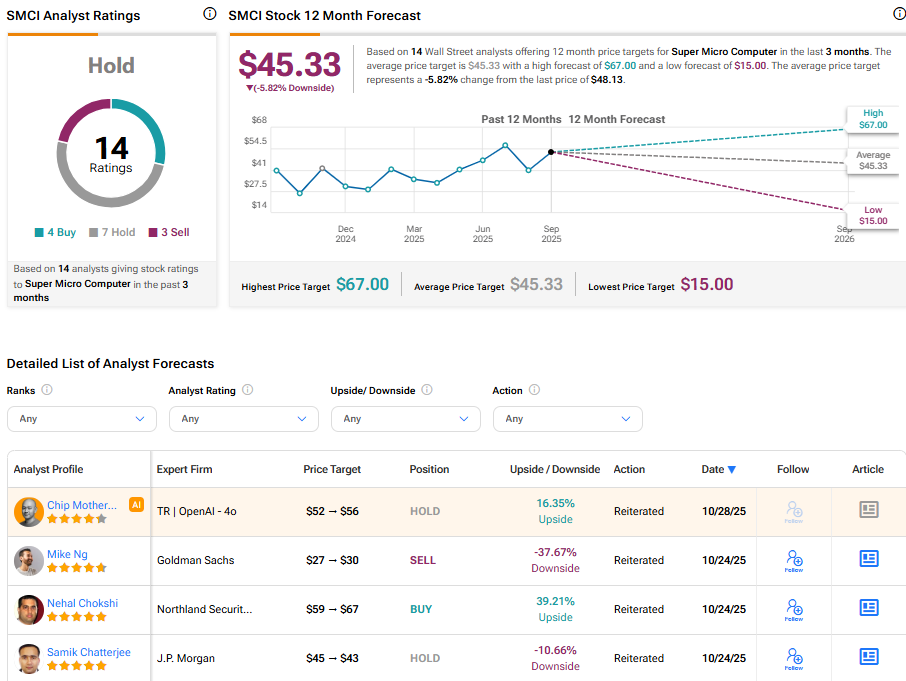

On TipRanks, SMCI stock has a Hold consensus rating based on four Buys, seven Holds, and three Sells assigned in the past three months. Meanwhile, the average Super Micro Computer price target of $45.33 implies a 5.82% downside risk from current levels.