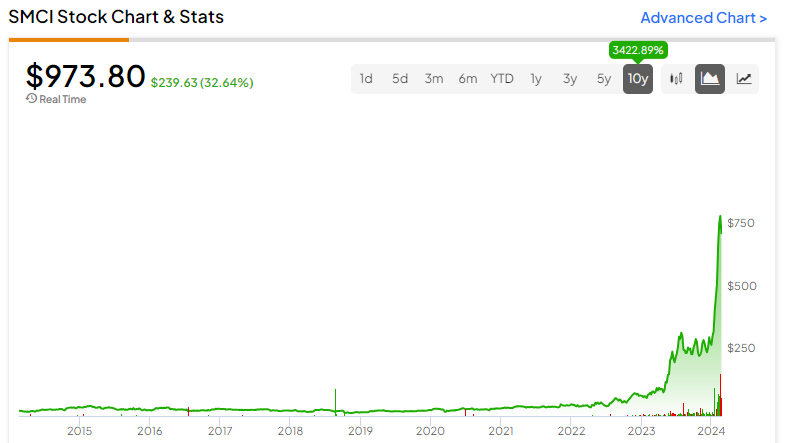

Super Micro Computer (NASDAQ:SMCI) has emerged as the top-performing stock in the artificial intelligence industry. Shares have more than tripled year-to-date, are up by 1,000% over the past year, and have gained roughly 5,000% over the past five years. Still, I am cautious about the stock’s long-term performance and believe the stock can wipe out a lot of shareholder value in a short amount of time when (if) the crash unfolds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I was first bullish on this stock in June 2023, back when it had a 16 P/E ratio. I became more bullish when the company announced its preliminary guidance and accumulated shares, often leading up to earnings. I retain my bullish stance for the short and mid-term but have trimmed most of my position.

Why Super Micro Computer and Nvidia Aren’t the Same

Super Micro Computer draws comparisons to Nvidia (NASDAQ:NVDA) since both of them are leaders in the artificial intelligence industry. Nvidia produces world-class chips, while Super Micro Computer produces the hardware for AI chips. Both companies are outgrowing most of the competition.

SMCI more than doubled its revenue in Q2 of Fiscal Year (FY) 2024, and net income went from $176 million to $296 million, marking a 68.2% year-over-year increase. Super Micro’s midpoint in revenue guidance suggests revenue in Q3 FY2024 will triple year-over-year from $1.3 billion to $3.9 billion.

The company also projects GAAP diluted EPS between $4.79 to $5.64. The $5.22 midpoint implies a 241% year-over-year gain. However, the mid-point is a small 2.4% quarter-over-quarter gain, and this is a weakness against the stock’s long-term rally.

These are the projected quarter-over-quarter (QoQ) gains SMCI will deliver based on midpoints:

- Revenue growth: 6.6% QoQ (12.0% at the high-end of guidance)

- EPS growth: 2.4% QoQ (10.6% at the high-end of guidance)

Now, let’s look at the quarter-over-quarter gains Nvidia delivered in its most recent earnings report:

- Revenue growth: 22% QoQ

- EPS growth: 33% QoQ

Nvidia aims to generate $24.0 billion in revenue in Q1 FY25. This guidance only indicates an 8.6% QoQ improvement. Quarter-over-quarter growth rates are slowing down for the leading AI firm. This will have a ripple effect across the entire industry as more earnings reports get released later in the year.

The Valuation

Nvidia is the gravitational force of the AI rally, so we will start by talking about this stock’s valuation first.

Nvidia closed out Fiscal 2024 with diluted earnings per share of $11.93. This figure represents a 586% year-over-year increase, which outpaces the stock’s 275% gain over the past year. As long as Nvidia’s profits outpace its stock gains, the NVDA rally is justified. Using the FY24 diluted figure, investors can arrive at a P/E ratio of roughly 65 at a $778 market price.

Further, GAAP net income grew by 769% year-over-year in Q4 FY24. That growth rate will help Nvidia settle into a lower valuation in the future.

Super Micro Computer doesn’t have the same luxuries with its valuation. Even if the company’s EPS grows by 241% year-over-year based on the midpoint, it falls well below the stock’s 936% gain over the past year. It made sense for SMCI to rally since it had been undervalued for so long. However, shares currently trade at a 76 P/E ratio, which is excessive for a company that will probably never have Nvidia’s profit margins.

Nvidia’s net profit margins are above 50%. Even with an impressive earnings report for Q2 FY24, SMCI’s net profit margins did not exceed 10%, and based on guidance, that trend won’t change in the next quarter. The company is projecting $5.64 GAAP diluted EPS on the high end and assumes it will have “a fully diluted share count of 60.1 million shares for GAAP.”

Calculating those numbers results in a forecast for $339.0 million in GAAP net income. Even if Super Micro Computer simultaneously hits the $3.7 billion low-end of revenue guidance, the company only ends up with a 9.2% net profit margin as the best-case scenario for this metric based on guidance.

Nvidia can maintain its rally because net income is growing more rapidly than its revenue and stock price. SMCI can’t claim either of those things, and this is critical for understanding the long-term bearish perspective.

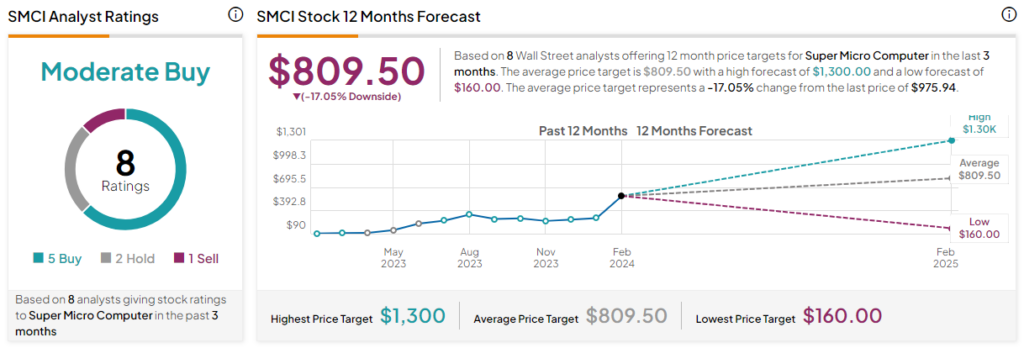

Is SMCI Stock a Buy, According to Analysts?

SMCI stock is rated as a Moderate Buy with five Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average SMCI stock price target suggests 17.05% downside potential. The highest price target is $1,300.

The Bottom Line on SMCI Stock

The company’s liquid cooling technology has made it a leader in the AI hardware space. Shares were previously undervalued at the start of the year, but a misguided comparison with Nvidia has turned the stock into a bubble.

SMCI’s guidance suggests low-single-digit quarter-over-quarter growth. The company will have no issue wooing investors with 2024 results, but the stock doesn’t seem prepared to face tough comps in 2025.

The bubble will continue as long as Nvidia and Super Micro Computer post earnings that demonstrate high revenue and earnings growth. Super Micro looks safe from a meltdown in 2024, but investors should be cautious about 2025 or early 2026 at the latest.

Even Nvidia is facing some challenges with its projected 8% quarter-over-quarter growth. The company doesn’t need to report another year of groundbreaking numbers to preserve its valuation, but SMCI must report exceptional numbers over the next two to three years to support the current valuation, and that doesn’t include any additional rallies.

Super Micro Computer is a well-run, profitable company, but investors are getting ahead of themselves with its valuation. The stock deserves to trade at a premium to competitors like Dell (NYSE:DELL) and Cisco (NASDAQ:CSCO) since SMCI has a big lead in the AI race. However, its growth is set to slow based on low quarter-over-quarter growth rates for its operations and Nvidia. That event can bring the valuation more in line with its competitors and result in a crash.