Super Micro Computer (NASDAQ:SMCI) was the best-performing S&P 500 (SPX) stock in Q1. It only entered the index a few weeks ago. The San Jose-based company is integral to the revolution in artificial intelligence (AI), building the highest-performance, fastest-to-market servers, which use Nvidia’s (NASDAQ:NVDA) A100 Graphics Processing Unit (GPU). I’m bullish on SMCI, even with the stock up 758% over 12 months. It’s a unique enabler of the AI revolution, and it still presents value, given its growth expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SMCI, The AI Enabler

Super Micro has carved a unique niche in the server market. In the context of AI, dedicated servers are vital to the sector’s development, providing the processing power for the intensive and complex workloads required by AI algorithm processing and machine learning. The company, which has a first-to-market mentality, prioritizes customization and efficiency. It’s this flexibility that allows it to cater to a wide range of customers, from Amazon (NASDAQ:AMZN) to Advanced Micro Devices (NASDAQ:AMD).

Moreover, Super Micro designs its own server components, creating a more streamlined service and leading to highly efficient systems that consume less power.

One reason the company has proven so successful is its decision to move away from traditional air cooling to its proprietary liquid cooling systems. This liquid, circulated throughout the server infrastructure, directly absorbs heat from components like GPUs used for generative AI.

Compared to air, liquid transfers heat more efficiently, and in turn, this allows for denser packing of powerful hardware in a server, aiding space utilization and processing speed. As a result, Super Micro offers cooler and quieter data centers. It also means significant energy savings on cooling costs.

Super Micro Computer Stock Has Incredible Strength

Super Micro isn’t short on momentum. The stock soared in 2023, closing the year up a staggering 238.97%. However, this was just the opening act. The company began 2024 with a bang. Its January 18 earnings pre-release highlighted just how far SMCI had come as it boosted its sales guidance. And then the company surpassed its pre-released guidance with a remarkable set of earnings released on 29 January.

The stock continued to gain as analysts reviewed and improved their long-term forecasts. It finally peaked when it was announced that the AI enabler would be joining the S&P 500. In short, the stock has two attractive traits: momentum and a track record of surprising to the upside.

SMCI’s Valuation Remains Enticing

Of course, Super Micro Computer looks expensive at first glance. It’s trading at 73x trailing-12-months earnings, making it one of the most expensive stocks using that metric on the S&P 500. However, the forward earnings multiple is 41.4x, and this trend continues as we move toward the medium term. Based on projected earnings, the price-to-earnings multiple is expected to fall to 29.7x in 2026 and 25.5x in 2027. Of course, the caveat is that these are projected earnings, and forecasts can be wrong.

In the short term, at least, there is little reason to assume that lofty expectations won’t be met. In many respects, 2024 should be a stronger year for AI and for Super Micro than 2023. One reason for this is that there was a global bottleneck in the Chip-on-Wafer-on-Substrate (CoWoS) packaging process during 2023.

Taiwan Semiconductor (NYSE:TSM), “the world’s dedicated semiconductor foundry,” has supposedly addressed those issues and has made significant improvements to output. In turn, this should mean more chipsets for Super Micro’s server infrastructure and more revenue.

Noting its integral role in the AI revolution, analysts now expect earnings growth to average 50.3% over the coming three to five years. That’s very considerable and means that Super Micro’s price-to-earnings-to-growth (PEG) ratio currently sits at just 0.82x. In this current and rather crowded tech market, I believe this PEG ratio indicates exceptional value.

Is SMCI Stock a Buy, According to Analysts?

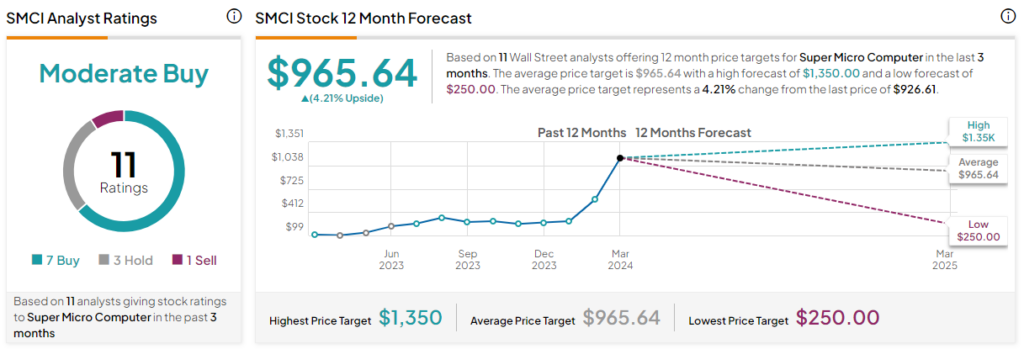

The company’s strong growth forecast is likely one reason why Super Micro remains a Moderate Buy, according to Wall Street analysts who have reviewed the stock over the past three months. The stock currently has seven Buy ratings, three Holds, and one Sell. The average SMCI stock price target is $965.64, inferring 4.2% upside potential from the current price. The highest share price target is $1,350, and the lowest share price target is $250.

It’s worth highlighting that the average share price target is heavily influenced by the lowest share price target, which was issued on January 29, 2024.

The Bottom Line on SMCI Stock

Super Micro Computer is a uniquely positioned company. It’s integral to one of the biggest market trends in decades, and its first-to-market approach has helped it develop something of an economic moat. And while the share price has already extended 20x in the last two years, growth expectations and the PEG valuation suggest this stock still has more room to rise. To me, it certainly doesn’t appear overbought.