What in the world happened at information technology hardware producer Super Micro Computer (NASDAQ:SCMI) in Wednesday afternoon’s trading? With the stock down over 23% at one point, it’s clear something happened, and a synonym for “disaster” is likely required to explain it. Based on the latest reports, it seems to be a common disaster fueling this plunge: overly-optimistic expectations.

Super Micro Computer posted its earnings report, and based on that data, there really wasn’t anything not to like. Earnings came in at $3.51, which handily beat analyst expectations calling for $2.91 per share. Revenue was also a healthy beat, coming in at $2.18 billion against analyst expectations of $1.98 billion. It was also 32.9% more revenue than Super Micro brought in last year at this time. Even projections shouldn’t have been an issue; Super Micro looked for revenue between $1.9 billion and $2.2 billion against projections of $2.05 billion. A beat wasn’t absolute, but rather, fairly likely. Moreover, earnings per share were projected around $3.21, which still fell in the range of Super Micro’s projected $2.75 to $3.50, if not so conclusively.

Yet, thanks to Super Micro’s connection to the AI field, those projections may have proven a problem. Investors are expecting huge returns out of AI anything these days; with most of Hollywood on strike thanks to AI, it’s clear AI will be a game-changer in a lot of places. That means huge gains for its creators…or at least, it should. A “narrow win”, in such an environment, will likely be looked at as “almost a total loss.” And since “narrow win” was pretty much Super Micro’s projection, that may be all the answer anyone needs.

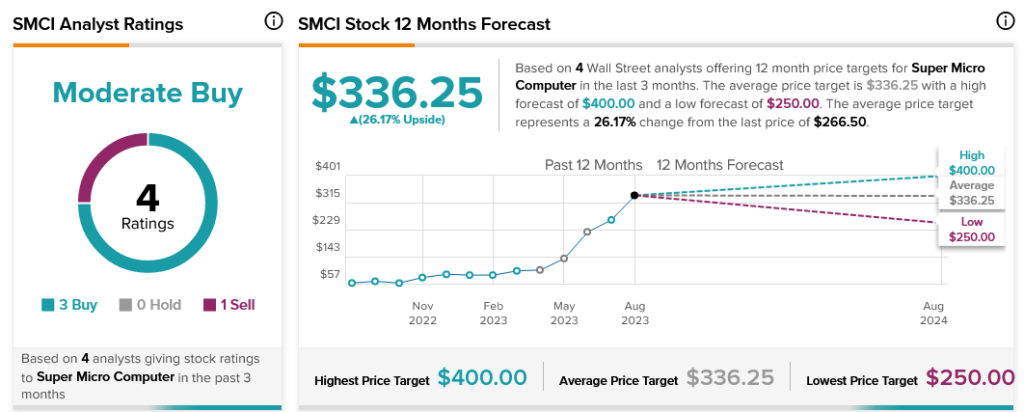

Meanwhile, analysts are reasonably upbeat. With three Buy ratings and one Sell, Super Micro Computer stock is considered a Moderate Buy. Further, Super Micro Computer stock comes with a 26.17% upside potential on its average price target of $336.25.