A report from the Wall Street Journal offers up a fun note going into this year’s Super Bowl matchup; when the teams in the Super Bowl post a score that measures at least 46 points, the stock market returns over 16.3%. If it’s a lower-scoring game, the average market return is just 7.2%. But there are a range of individual stocks whose outcomes will be impacted by the big game, and they’re looking mixed right now.

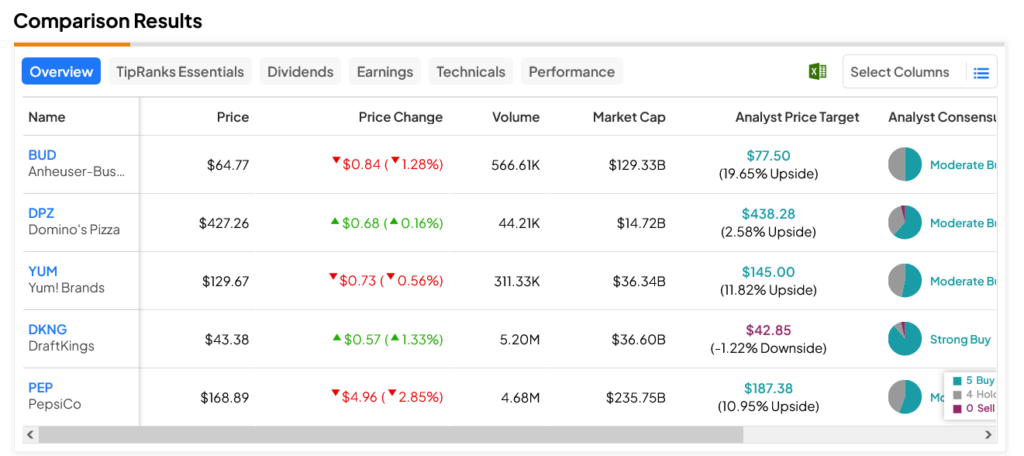

Domino’s Pizza (NYSE:DPZ) is up fractionally, while DraftKings (NASDAQ:DKNG) is up just under 1.5%. Meanwhile, Yum Brands (NYSE:YUM) is down fractionally, Anheuser-Busch InBev (NYSE:BUD) is down modestly, and PepsiCo (NASDAQ:PEP) is down over 3% in Friday morning’s trading session.

These five companies represent elements of a significant part of the Super Bowl festivities for many. Domino’s and Yum Brands offer those game-day pizzas, while Anheuser-Busch InBev offers multiple beer brands. PepsiCo, of course, offers non-alcoholic alternatives but also has control of the Frito-Lay brand, which will supply many with chips and other snacks during the game. And DraftKings, well, that’s for those who want to bet a little money on the game’s outcome. So, from pre-game to post-game, these five companies offer a representative look at the overall experience.

Super Bowl Spending Is up 6%

Word from the National Retail Federation says that Americans are planning to spend a combined $17.3 billion on the Super Bowl this year, and that’s up $1 billion from last year. Another report notes that Super Bowl spending is up around 6%, which is twice the rate of food inflation seen in the last Consumer Price Index report for January. So there is some further economic benefit for companies, but their stocks aren’t acting like they’re in line for a windfall, which they are.

Which Super Bowl Stocks Are a Good Buy Right Now?

Turning to Wall Street, the laggard among Super Bowl stocks is DKNG stock. A Strong Buy with an average price target of $42.85, it comes with a 1.22% downside risk. Meanwhile, the leader is BUD stock, as this Moderate Buy offers 19.65% upside potential on its average price target of $77.50 per share.