Suncor Energy (NYSE:SU) (TSE:SU) CEO Rich Kruger has opened the door to the possibility of selling the company’s Petro-Canada retail operations, which has over 1,500 gas stations across Canada. Back in 2022, the oil company had also considered selling Petro-Canada but ultimately decided not to after a review suggested it might not attract the desired selling price, which Suncor estimated to be between $3.8 billion and $5.7 billion.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Interestingly, Kruger had previously facilitated the sale of Esso retail stations (a Petro-Canada competitor) during his previous tenure at Imperial Oil (NYSE:IMO). However, he did note that it wasn’t a priority to sell off Petro-Canada, only a possibility. Kruger’s main concern since taking over Suncor last April has been to improve efficiency. Therefore, it seems reasonable to believe that a sale will only happen if the CEO believes it will help him reach that goal.

Is Suncor Still a Good Buy?

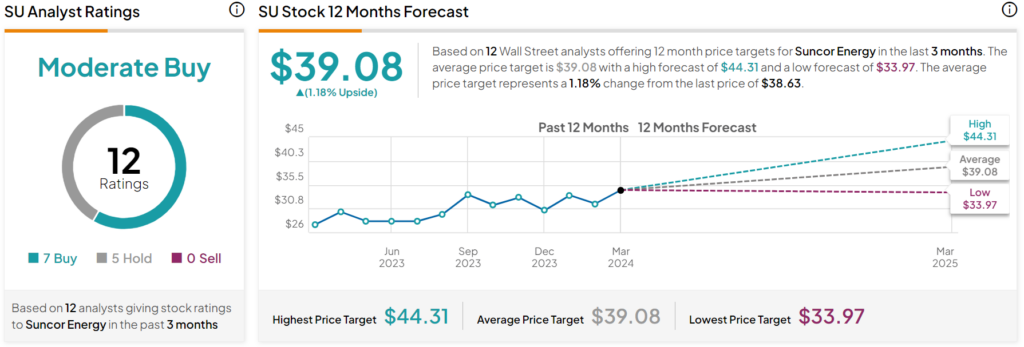

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SU stock based on seven Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 27% rally in its share price over the past year, the average SU price target of $39.08 per share implies 1.18% upside potential.