Aerospace stock Boeing (BA) has had a disturbing way these days of bringing out things that should be good news, but that investors did not seem to care much about. Yesterday it was the win from the Federal Aviation Administration (FAA), and today, it is that work has begun on a plane that will ultimately succeed the 737 MAX. Boeing investors just could not get behind the idea, though, and shares slipped modestly in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new plane, reports note, is a single-aisle aircraft intended to take over for Boeing’s beleaguered workhorse, the 737 MAX. Boeing has already been shopping around for new engines, including a stop at, of all places, Rolls-Royce Holdings (RYCEY). Naturally, this is still an early-stage development, so it will likely take a while before we actually see much out of this model.

But with Boeing finally getting most of its legal challenges settled, as well as some “various projects” that were in the pipeline, reports suggest that Boeing is about to “…free up a lot of capital for us to focus on what’s next,” according to word from CEO Kelly Ortberg. It certainly does not hurt matters that Boeing has been working on improving its quality and internal processes, two points that have plagued Boeing’s operations for the last two years or so.

Meanwhile, On the Union Front

We also got word today about Boeing’s efforts to set up a contract with the union in St. Louis. It is not going well, reports note, as the union apparently walked out of a meeting with a federal mediator. Dan Gillian, Boeing Air Dominance vice president and general manager, noted: “Despite a full day of mediation, we’re disappointed the union walked out on talks and rejected our offer to settle the strike. The union continues to mislead its members by inflating their expectations, promising outcomes that they know are unrealistic and not aligned with the current market realities. As we have said multiple times, we are open to constructive feedback from the union within the overall economics of our offer, which is at the top of the market for Midwest manufacturing.”

The union, meanwhile, took exception, noting, “We see Boeing has again mischaracterized our negotiations. Yesterday’s mediation session ended with the company giving us an offer that has already been rejected by our membership. It is clear the company was completely unprepared to resolve this strike. We told mediators that we remain fully available when the company has an improved offer.”

Is Boeing a Good Stock to Buy Right Now?

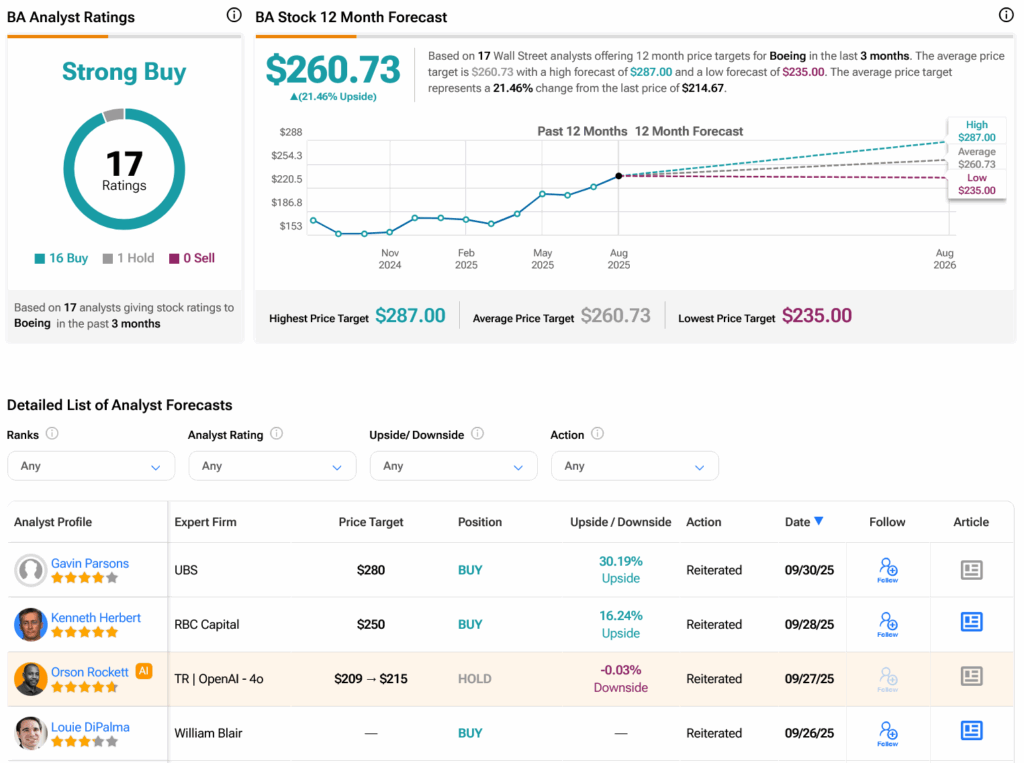

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 16 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 40.76% rally in its share price over the past year, the average BA price target of $260.73 per share implies 21.46% upside potential.