Telecom equipment maker Ericsson (NASDAQ:ERIC) intends to eliminate about 1,400 jobs in its home country Sweden, as the company is facing slowing demand for its 5G gear in some of the key markets like North America. These job cuts are a part of the company’s plan to reduce costs by 9 billion Swedish kronor ($861 million) by the end of 2023.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

A company spokesperson stated that agreements have been reached with Ericsson’s Swedish unions on how to manage the layoffs, Reuters reported. The company plans to execute the headcount reductions via a voluntary program. Ericsson is expected to announce further layoffs in other countries in the coming days.

At the Ericsson Capital Markets Day held in December 2022, the company cautioned investors, “After record capex levels in North America in 2022, build-out is expected to normalize in 2023, beginning in Q4 of this year.”

Some of the company’s customers in North America have been cutting down their capital expenditure in response to macro challenges. Nonetheless, demand in growth markets like India is expected to address the weakness in the U.S. and other advanced markets to some extent.

Ericsson expects to meet the lower end of its long-term EBITA (earnings before interest, taxes, and amortization) margin target of 15% to 18% by 2024, as several of its higher profitability markets are showing signs of a slowdown. The company aims to reduce costs and improve margins through various initiatives, including reduction of consultants, streamlining of processes, and layoffs.

Is ERIC a Good Buy?

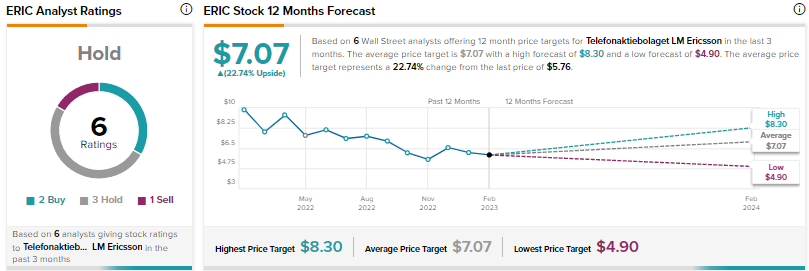

Wall Street is sidelined on Ericsson, with a Hold consensus rating based on two Buys, three Holds, and one Sell. The average ERIC stock price target of $7.07 suggests 22.7% upside.