While no one ever really considered Restaurant Brands (NASDAQ:QSR) to be high cuisine, investors are finding it increasingly palatable. It’s notched up just a bit in Tuesday afternoon’s trading to reach a new 52-week high, and it’s largely thanks to an earnings report that saw former laggards pick up the slack.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Restaurant Brands’ latest quarter came in nicely, with earnings at $0.75 per share against projections that called for $0.63 per share. Revenue, meanwhile, also came in ahead at $1.59 billion against the $1.56 billion predicted. This represented a 9.7% increase over this time last year. The individual segments showed some particular high points. The two leaders this time around were Burger King and, in a huge surprise, Tim Horton’s.

While normally, Tim Horton’s had proved something of a drag on Restaurant Brands’ earnings sheet, this time, it was the big winner. TH Canada saw a 16% rise by itself. And even Burger King brought in a 10.8% rise, long above the 6.27% analysts projected. But Restaurant Brands isn’t taking that for good enough; it’s got plans to drop $400 million into a project it calls “Reclaim the Flame.” That project includes $150 million for advertising and $250 million for various restaurant improvements. Macro concerns are present, certainly, but Restaurant Brands expects it will hold up well even with customers scaling back.

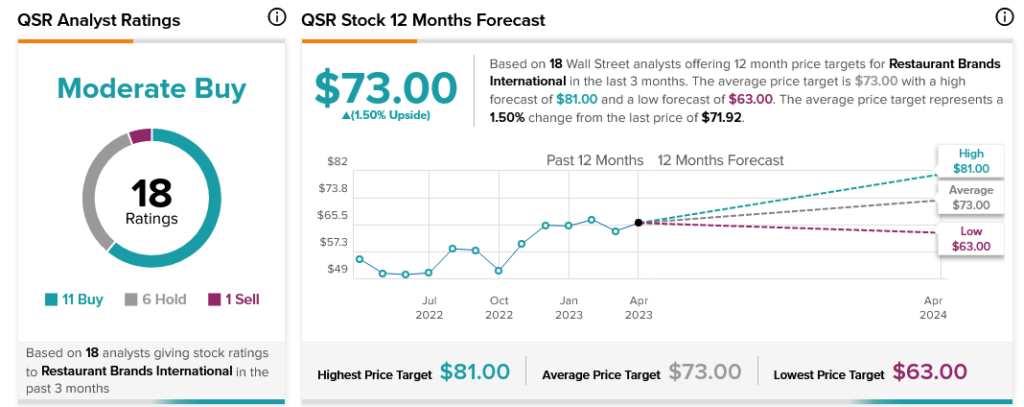

Analysts are somewhat skeptical about the potential turnaround. With 11 Buy ratings, six Holds, and one Sell, Restaurant Brands stock is currently considered a Moderate Buy. Moreover, its stock offers a paltry 1.5% upside potential thanks to an average share price of $73 per share.