The stock of Stride (LRN) is down 48% after the online education company delivered weak forward guidance and reported soft student registration numbers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stride managed to report earnings per share (EPS) of $1.52, which topped the consensus Wall Street estimate of $1.25. Revenue of $621 million for what was the company’s Fiscal first quarter also came in above analyst estimates of $613 million.

Despite the top and bottom line beats, Stride announced that its student enrollments during the quarter totaled 247,700, up 11% from a year earlier but below the 249,200 registrations that Wall Street had anticipated, sending the stock lower.

Bad Guidance

Additionally, Stride guided for revenue of $620 million to $640 million in the current quarter. That guidance fell short of analysts’ forecasts that called for $648 million. Consequently, Stride, a for-profit education company that provides mostly online education programs, is seeing its stock plunge nearly 50% on the day, wiping out all of its 2025 gains.

“While demand, as indicated by application volumes, remains healthy, overall growth was tempered,” said CEO James Rhyu on an earnings call with analysts and media. Management added that the new learning and technology platforms it added this year haven’t gone smoothly, leading to negative customer feedback and high withdrawal rates from its services.

Is LRN Stock a Buy?

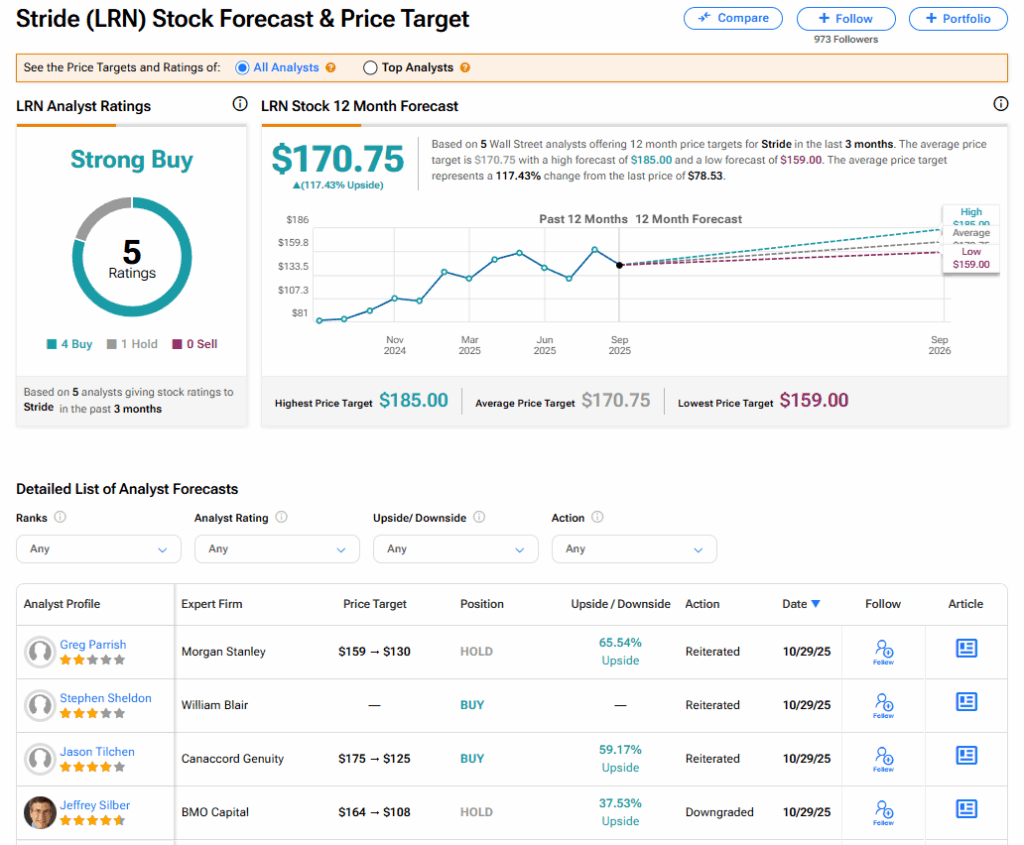

The stock of Stride has a consensus Strong Buy rating among five Wall Street analysts. That rating is based on four Buy and one Hold recommendations issued in the last three months. The average LRN price target of $170.75 implies 117.43% upside from current levels. These ratings are likely to change after the company’s financial results.