Strategy (MSTR), formerly known as MicroStrategy, is scheduled to announce its results for the third quarter of 2025 after the market closes on Thursday, October 30. The company remains one of the market’s top Bitcoin proxy stocks, with shares up about 10% over the past year. Strategy has benefited from growing Bitcoin adoption, rising institutional participation, and improving regulatory sentiment toward crypto assets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

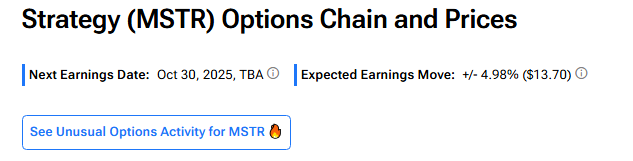

Based on options pricing, traders are expecting a 4.98% move in either direction, following the results. This indicates that investors expect only a mild reaction this time, as attention shifts to the company’s Bitcoin strategy, balance sheet moves, and plans for future institutional adoption.

Meanwhile, Wall Street expects MSTR to report a narrower loss of $0.10 per share compared to $1.72 per share in the prior-year quarter. Meanwhile, the company is expected to report a 0.5% growth in its revenue to $116.65 million in Q3 2025.

Recent Event Ahead of Q3

According to a recent filing, Strategy sold $43.4 million in preferred stock between October 20 and October 26, 2025, and used the proceeds to purchase 390 bitcoin. The company said the coins were bought at an average price of $111,117 each, including fees, increasing its total holdings to 640,808 bitcoin, valued at $47.44 billion, with an average cost of $74,032 per bitcoin.

Top Citi Analyst’s Views Ahead of Strategy’s Q3 Earnings

Heading into Q3 results, Citi analyst Peter Christiansen initiated coverage on Strategy with a Buy rating and a $485 price target, implying roughly 64% upside from current levels. The 4-star analyst said that under Executive Chairman Michael Saylor, the company has evolved into what Citi calls a “Digital Asset Treasury.”

Strategy uses debt and preferred shares to grow its Bitcoin holdings while trying to keep shareholder dilution under control. Citi said this strategy gives investors greater exposure to Bitcoin’s gains, but also heightens losses when the market turns lower.

Meanwhile, Citi expects the stock’s premium to net asset value (NAV) to stay in the 25–35% range, based on a projected 9.6% Bitcoin yield in 2026. Christiansen said this premium reflects investor confidence in the company’s ability to grow its Bitcoin per share.

Is MSTR Stock a Buy Right Now?

According to TipRanks, MSTR stock has a consensus Strong Buy rating among 15 Wall Street analysts. That rating is based on 14 Buys and one Sell assigned in the past three months. The average MSTR price target of $540.32 implies an 82.77% upside from current levels.