Recently, Stratasys (NASDAQ:SSYS) turned down a sweetened offer of $20.05 per share from Nano Dimension (NASDAQ:NNDM), leading to a slight increase in the share prices of both companies at the time of writing. The board of Stratasys believes the proposal undervalues the 3D printing company and isn’t in the best interest of shareholders. Doubts also linger about Nano’s authority to complete an acquisition, given its ongoing legal battle with its largest shareholder, Murchinson.

The Stratasys board is concerned about the potential negative impacts of a takeover amidst Nano’s uncertain authority. This rejection follows two previous offers from Nano Dimension, which were also turned down. Nano Dimension asserted that its latest offer of $20.05 was its “best and final.” In response, Nano Dimension threatened to initiate a tender offer for a minimum of 51% of Stratasys’ outstanding common stock at $18 per share if Stratasys’ board remains uncooperative.

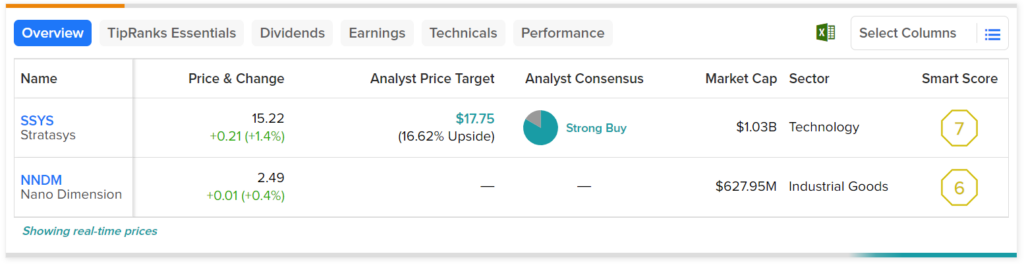

Although Stratasys’ board believes that Nano Dimension is undervaluing the company, Wall Street seems to think differently. Indeed, analysts have an average price target of $17.75 per share. Nevertheless, this still implies 16.62% upside potential from current levels.