Give aerospace stock Boeing (BA) credit. At least the ongoing labor troubles in St. Louis are generating negotiations. And after the union refused Boeing’s latest offer, the union came back with its own counter-offer. This left investors at least somewhat pleased, and Boeing shares gained fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The International Association of Machinists and Aerospace Workers District 837 came back with what it called a “modified” four-year agreement. The last contract offer, a five-year agreement, had been rejected by the union, though reports suggest the rejection was actually fairly close.

The union came back with a new proposal that calls for a $10,000 ratification bonus, paid over two years. The first half is payable immediately, and the other half is payable in year three of the agreement. The union also called for wage increases of 8% in the first year, and 4% every year thereafter for the life of the agreement. The IAM also took a shot at Boeing, saying, “Our members aren’t going to be fooled by PR spin. It’s well past time for Boeing to stop cheaping out on the workers who make its success possible and bargain a fair deal that respects their skill and sacrifice.”

“Supply-Constrained”

Boeing may have another problem waiting in the wings, notes analyst Jim Cramer. Specifically, Boeing may be one of the most supply-constrained operations out there aside from tech companies. In fact, Cramer looked for Boeing to talk about supply constraints on all its aircraft, from the narrow-body planes to the wider models.

Cramer also pointed out, “…all big Boeing suppliers and aircraft suppliers in general, are reaping the benefits of the outsized demand for planes in the attendant maintenance boom.” And indeed, all that demand for aircraft is starting to weigh heavily on supply as Boeing eagerly tries to push all the planes it can out the door. This is especially true given that the FAA is backing down on regulation somewhat.

Is Boeing a Good Stock to Buy Right Now?

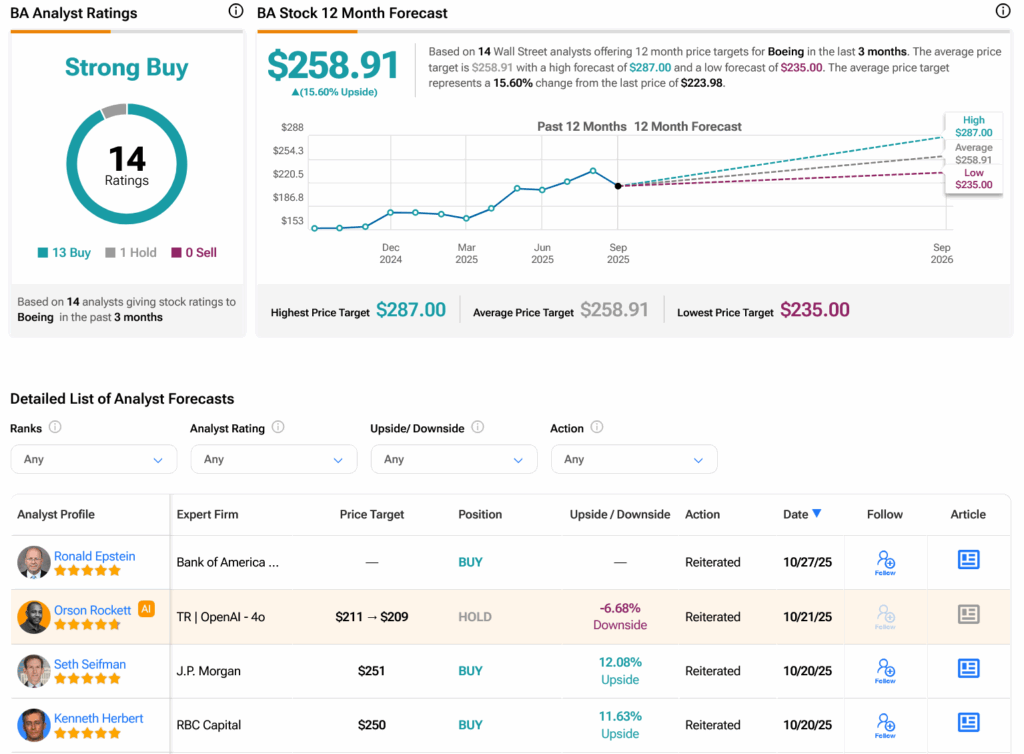

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 13 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 45.77% rally in its share price over the past year, the average BA price target of $258.91 per share implies 15.6% upside potential.