Stellantis (STLA), the world’s fourth-largest automaker, has named Italian automotive executive Antonio Filosa as its new chief executive officer (CEO).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Filosa replaces former CEO Carlos Tavares, who resigned last year under pressure from the company’s board of directors. Filosa, who is currently Stellantis’ chief operating officer (COO) for the Americas, will take the helm of the car company on June 23.

The appointment returns Stellantis, which was created from the 2021 merger of France’s PSA Peugeot and Italian-U.S. carmaker Fiat Chrysler, to Italian hands. John Elkann, heir to the Fiat-founding Agnelli family, remains chairman of Stellantis, whose automotive brands include Chrysler, Dodge and Jeep.

Rising Competition

In a news release, Stellantis said that the board’s choice was unanimous and called Filosa a “natural choice” due to his leadership track record and knowledge of the automotive business. Filosa joined Fiat in 1999, spending much of his career in Latin America where he held positions from plant manager to head of purchasing.

He was promoted to chief operating officer of the Americas in 2024 in an executive shake-up as sales slumped in North America, the company’s main profit center. Stellantis has been lagging its competitors in the transition to electric vehicles and faces stiff competition from Chinese automakers.

The stock of Stellantis has declined 13% this year.

Is STLA Stock a Buy?

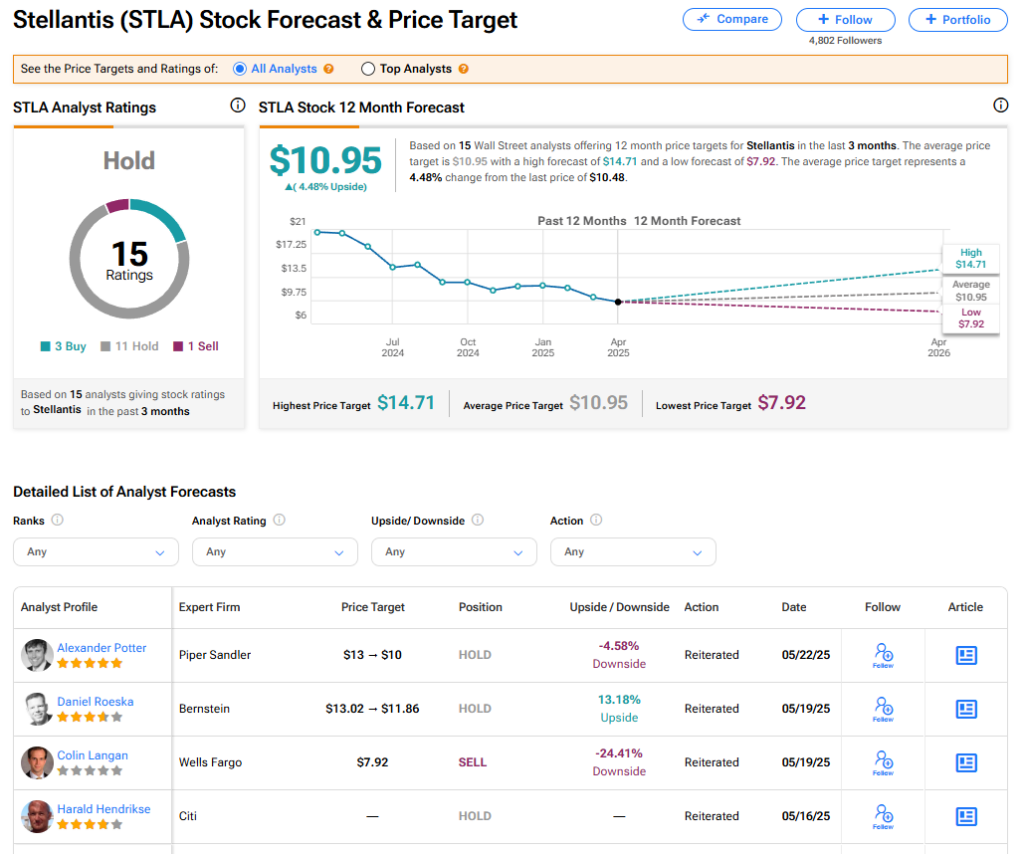

The stock of Stellantis has a consensus Hold rating among 15 Wall Street analysts. That rating is based on three Buy, 11 Hold, and one sell recommendations issued in the last three months. The average STLA price target of $10.95 implies 4.48% upside from current levels.