Leading automaker Stellantis (NYSE:STLA)(FR:STLAP) will invest €1.5 billion to acquire about a 20% stake in Leapmotor, a fast-growing Chinese EV (Electric Vehicle) maker. The move is part of the company’s strategy to meet its electrification targets, boost its sales in the world’s largest EV market, and become more competitive in Europe and other parts of the world. Let’s delve deeper.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Stellantis’ Strategic Partnership with Leapmotor

Stellantis is struggling to grow its sales and market share in China owing to the heightened competition from domestic players. Given the competitive headwinds, Stellantis’ market share in China fell to 0.3% in the six months ended June 30, 2023, from 0.5% in the prior-year period. Stellantis CEO Carlos Tavares said, “Through this strategic investment, we can address a white space in our business model and benefit from Leapmotor’s competitiveness both in China and abroad.”

This deal will result in the formation of Leapmotor International, a JV (joint venture) between the two corporations, with Stellantis holding a majority stake of 51%. Additionally, this new JV will enjoy exclusive rights to export, manufacture, and sell Leapmotor products outside China.

Stellantis intends to leverage Leapmotor’s cost-efficient EV ecosystem in China to meet its electrification targets by 2030. Notably, Stellantis has committed to investing over €50 billion in electrification over the next decade. It aims to achieve a 100% passenger car BEV (battery electric vehicles) sales mix in Europe and a 50% sales mix of BEV passenger cars and light-duty trucks in the U.S. by 2030.

Stellantis will gain two seats on Leapmotor’s Board of Directors, and it will appoint the CEO of the new JV. Further, the new JV will start shipments in the second half of 2024. With this backdrop, let’s look at analysts’ recommendations for STLA stock.

What is the Long-Term Forecast for Stellantis?

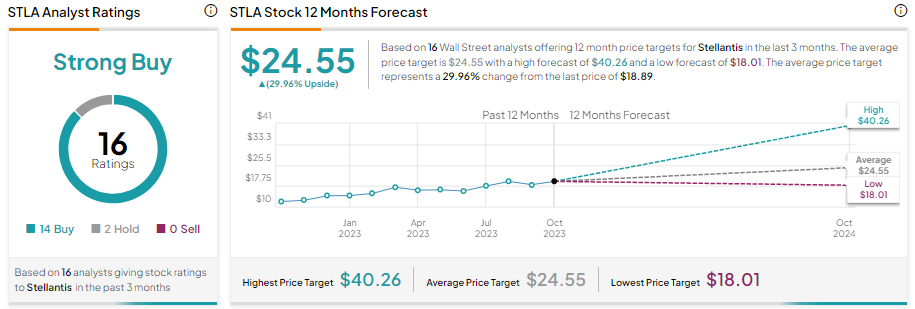

Wall Street analysts are bullish about Stellantis’ prospects. With 14 Buy and two Hold recommendations, Stellantis stock has a Strong Buy consensus rating. Further, the average STLA stock price target of $24.55 implies 29.96% upside potential from current levels.