With the recent auto strike finally settled, auto manufacturer Stellantis (NYSE:STLA) has been working to rebuild its inventory and get back on track. In fact, it’s got plans to take on a whole new market. However, investors aren’t exactly pleased by the notion, sending Stellantis shares down fractionally in Tuesday afternoon’s trading. Stellantis has been working diligently to expand its foothold in the commercial vehicle market. It’s been pushing for greater market share in Asian markets and also released its new Pro One campaign in North America to get more commercial users driving Stellantis-made vehicles.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

All of this even has a target date; Stellantis hopes to secure its position as a leader in the commercial vehicle market in the next six years. It’s already made substantial advances on that front; it holds 30% of the European market for commercial vehicles and has also raised its global commercial vehicle sales by 12% over the same time last year. In aid of this, it’s got a complete line of commercial-focused vehicles, including five different vans, 10 classes of pickup, and a “micro-mobility” vehicle. Ultimately, reports note, Stellantis looks to make half of its total revenue come from commercial vehicles by 2030’s dawn.

But Less So the EV Market

Meanwhile, Stellantis isn’t planning to make a huge splash in the electric vehicle (EV) market. In fact, Stellantis’ CEO, Carlos Tavares, warned other automakers against joining in the EV price war that Tesla (NASDAQ:TSLA) started. Those who join in, Tavares intoned grimly, run the risk of joining a “bloodbath” in progress. Given that Ford (NYSE:F) has been spotted scaling back production, holding off on that field right now—until it shakes out a bit—might be for the best.

Is Stellantis a Good Stock to Buy Now?

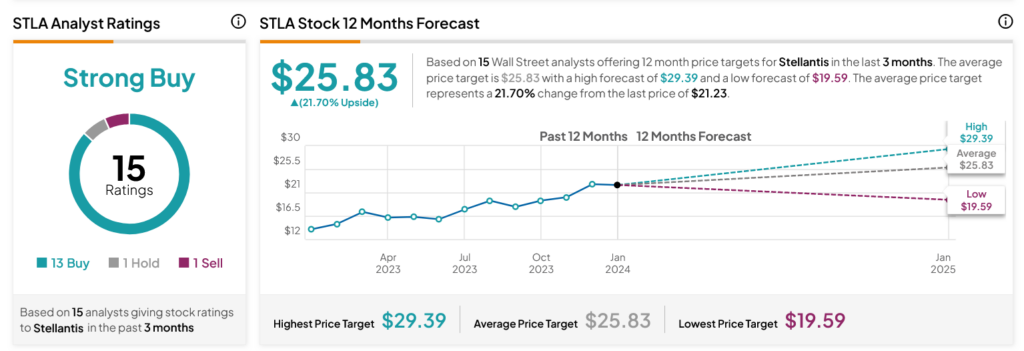

Turning to Wall Street, analysts have a Strong Buy consensus rating on STLA stock based on 13 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 0.55% increase in its share price over the past year, the average STLA price target of $25.83 per share implies 21.7% upside potential.