A strange development emerged from automaker Stellantis (NYSE:STLA) today, as it brought back a car that hasn’t been seen in years. Moreover, it brought that car back with a new electric edge, which caught a lot of attention. However, the attention was a bit more tepid from investors, who sent Stellantis shares up fractionally in Tuesday afternoon’s trading. The car in question is the Fiat 500e, which has been seen before–it was discontinued in 2019–but is now making its way to the U.S. market in a bid to address tightening requirements around fuel economy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Also new is the price tag when it goes live in the American market: a whopping $34,095. There’s no word yet if the Fiat 500e will qualify for any kind of government incentive program or tax credit. However, if it doesn’t, then it may prove to be a rather flat seller as those looking for a new—or rather new-to-them—car will go looking somewhere that isn’t the equivalent of a down payment on a house.

Fiat 500e In, Jeep Renegade Out

Perhaps the most interesting part about this new offering is its timing. Just as the Fiat 500e is emerging and offering drivers a new option for a small, city-focused car, Stellantis also removed an option from the board: the Jeep Renegade. The Renegade, an Italian-made SUV, will no longer be available in the U.S. or Canadian markets as of 2024. As a crossover vehicle, it doesn’t align with the growing demand for SUVs and larger trucks. Meanwhile, sales of the Jeep Renegade are down 35% so far this year, based on word from The Detroit News.

Is Stellantis Stock a Good Buy?

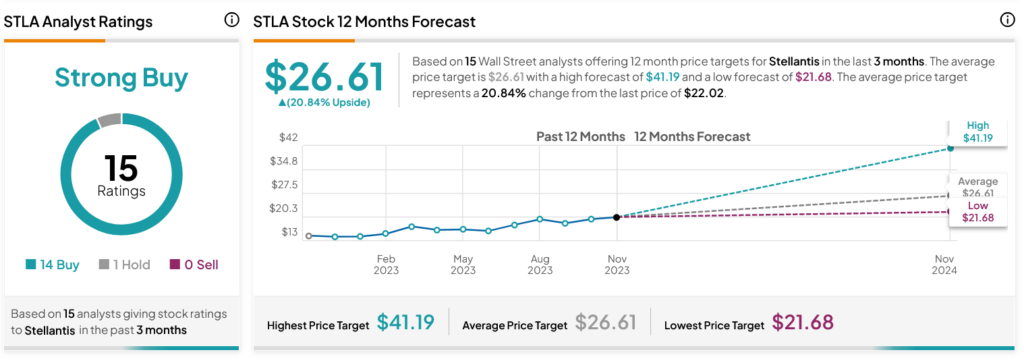

Turning to Wall Street, analysts have a Strong Buy consensus rating on STLA stock based on 14 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 58.27% rally in its share price over the past year, the average STLA price target of $26.61 per share implies 20.84% upside potential.