In a move that might well leave the United Auto Workers (UAW) deeply, deeply concerned, automaker Stellantis (NYSE:STLA) is nearing a deal to buy a stake in a Chinese electric vehicle company. Investors may be a bit confused by this move, but they’re not unhappy with it, as Stellantis shares gained fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Should the deal go forward as planned, Stellantis will end up with a 20% share of Zhejiang Leapmotor Technologies (HK:9863). That will give Stellantis a little more of the biggest market for vehicles on Earth right now.

Further, the two companies are looking to start a joint venture as part of the transaction, which would let Stellantis sell Leapmotor cars outside of China while also allowing Stellantis to see how Leapmotor assembles its vehicles, including details on the parts. Those could be useful in Stellantis’ own electric car aspirations.

While there are no terms on the deal as of yet, reports note that Leapmotor has a market value of around $5.4 billion right now, thanks to recent gains in the share price caused by Stellantis’ interest. That, in turn, would put a roughly $1 billion price tag on a 20% stake, assuming the current valuations are used.

Meanwhile, this move might be a major issue in the near term for the UAW, which has been working to unionize electric vehicle operations. Should Stellantis pull a pivot into electric vehicle operations, that could take a lot of leverage out from under the UAW.

Is Stellantis a Good Stock to Buy?

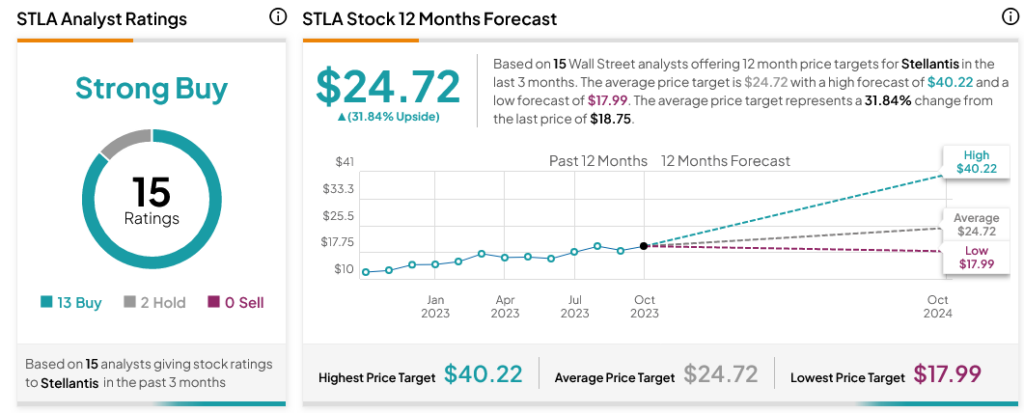

Turning to Wall Street, analysts have a Strong Buy consensus rating on STLA stock based on 13 Buys and two Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average STLA price target of $24.72 per share implies 31.84% upside potential.