Stellantis (NASDAQ:STLA) isn’t really a household name when it comes to cars. Its Jeep line certainly is, but Stellantis itself, not so much. And now, Stellantis also wants to elevate its presence as an electric vehicle stock as well. The move didn’t sit well with investors, however, as Stellantis closed down 1.46% in Wednesday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In aid of that, Stellantis rolled out the STLA Medium Platform, a vehicle construction ideology that will produce vehicles with 435-mile total ranges. That’s actually the best in its class, Stellantis noted, and also revealed STLA Medium Platform vehicles would offer energy efficiency and embedded power systems. Further, Medium Platform vehicles will compete in the C and D-segments, which alone counted for 35 million vehicles sold overall.

The good news about this is that customers don’t seem to be backing off vehicle purchases much. Earlier today, we discovered that General Motors (NYSE:GM)’s sales shot upward in the second quarter, with GM now on track to break another set of analyst forecasts. And with Stellantis’ line of electric vehicles poised to get some of the best mileage around in the compact and midsize markets, that could make it a serious competitor. Better yet, the STLA Medium platform will even come with optional long-range batteries, says Car & Driver, which will help open up the field even further.

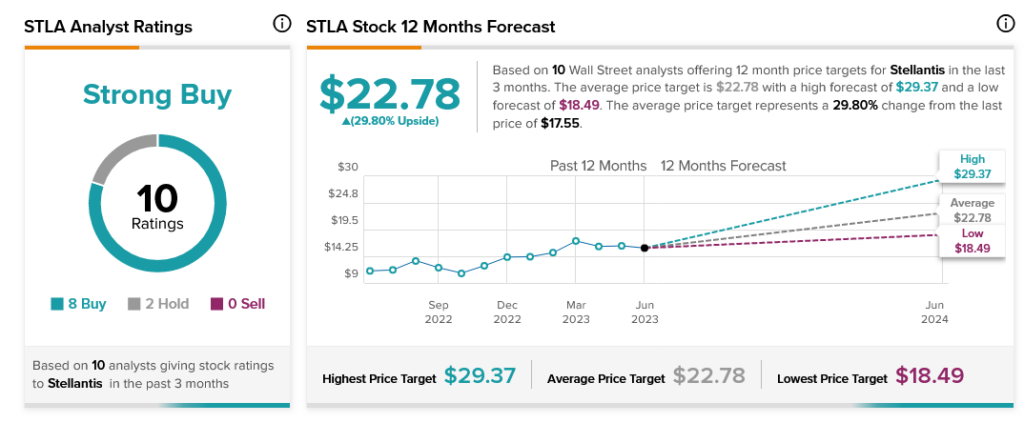

Stellantis is definitely on the move in the electric vehicle market, though it will have serious competition therein. With eight Buy and two Hold ratings, Stellantis stock is considered a Strong Buy. Further, with an average price target of $22.78, that gives Stellantis stock a 29.8% upside potential for its investors.