Nvidia (NASDAQ:NVDA) CEO Jensen Huang’s keynote at GTC last week featured a slew of announcements that helped propel the stock beyond a historic $5 trillion market cap.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Riding that momentum, Bank of America analyst Vivek Arya, who ranks among the top 3% of Street stock experts, met with Nvidia CFO Colette Kress and members of the IR team, describing the discussion as a “very positive” one.

For one, the meeting strengthened Arya’s confidence in Nvidia’s “solid visibility.” The discussion indicates that Nvidia’s projected $0.5 trillion in data center orders for CY25/26 (roughly FY26/27) is likely at least 10% above the Street’s $446 billion forecast and is based on a conservative $25 billion per gigawatt content assumption. This estimate is lower than the figures highlighted in Nvidia’s recent roadshow slides, where $30–$40 billion per gigawatt content (from a total capex of $50–$60 billion) is targeted for each gigawatt of compute power. The actual mix might include a combination of products, such as flexible MGX or reference NVL racks, CPU and non-CPU components, and varying networking and cabling configurations. Nonetheless, if Nvidia is indeed involved in a 20 GW total buildout in CY25/26, Arya thinks there is potential upside to the $0.5 trillion in orders.

“Separately we believe NVDA can continue to maintain its strong mid-70s GM on the strength of its products, and as it has strong co-design and volume support from multiple memory suppliers,” Arya went on to say.

The company also suggested that they can ship more than 10 million GPUs if demand supports it, as supplies across the board – including CoWoS and HBM – are sufficient. Power constraints are not a concern, since customers would only place orders after ensuring their power needs are met. So far, Nvidia sees roughly 10 million Blackwell/Rubin GPU orders for CY25/26, which Arya believes “could be upsided.”

On the hot topic of China, one possible outcome from the tariff and trade truce between the U.S. and China is the possibility that Nvidia (and AMD) could resume GPU shipments to China. However, China has already signaled limited interest in older-generation products, so unless shipments of newer-generation Blackwell-class GPUs are approved, Arya continues to assume that China’s data center contribution is “effectively zero.”

All told, despite crossing the $5 trillion milestone, the 5-star analyst thinks Nvidia’s valuation “remains compelling.” As such, Arya sees NVDA as a top pick, assigning a Buy rating and a $275 price target, suggesting the shares will gain 35.5% over the coming months. (To view Arya’s track record, click here)

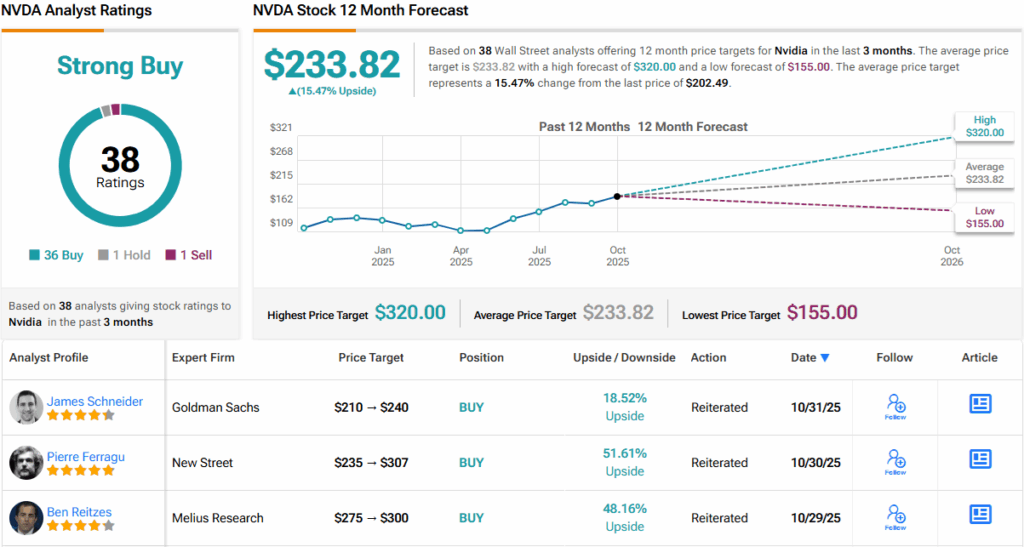

That’s hardly a controversial take on Wall Street right now. NVDA stock claims a Strong Buy consensus rating, based on a lopsided mix of 36 Buys and 1 Hold and Sell, each. The forecast calls for 12-month returns of ~15%, considering the average target clocks in at $233.82. (See Nvidia stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.