Meme stocks have been having another moment. Following the reappearance of meme stock lightening rod Roaring Kitty, stocks that fall under the category were last week partying as if it was 2021 all over again.

Being a member of the cohort, AMC Entertainment (NYSE:AMC) shares were reaping the benefits, at some point surging by more than 300% over a two-day period.

The struggling theater chain operator has been saddled with debt and quickly took the opportunity to strengthen its financial position. First by completing its $250 million ATM program launched toward the end of March (although here it cashed in a bit early as the share price really exploded after the program’s completion), and then by announcing the issuance of class A stock in exchange for notes so the company can somewhat reduce its highest interest loan outstanding.

Looking at all these shenanigans taking place, 5-star investor Max Greve thinks the renewed meme mania might already be winding down.

“It seems clear management struck while the iron was hot, but it’s less clear whether it will have further opportunities to do so,” Greve commented. “The meme rally seems to be running out of steam, which might mean the window of opportunity has closed already.”

While many investors tend to focus on the dilutive nature of the moves taken by AMC, Greve acknowledges that despite the dilution, should the capital be used wisely, such sales “might be to shareholders’ long-term advantage.”

That said, looking at how the company is run, Greve thinks the way AMC conducts its business is flawed. “AMC’s underlying business model, which includes a self-defeating revenue share system with studios, is the main cause of its losses and needs to be addressed for a fundamental rebound.”

The problem, however, is that management has so far given “absolutely no indication” that it plans on doing so. “And as long as that continues,” Greve goes on to add, “no amount of meme rallies or fresh capital will solve the problem.”

Thus, unless there’s a “complete strategic change,” Greve thinks investors should avoid AMC shares. (To watch Greve’s track record, click here)

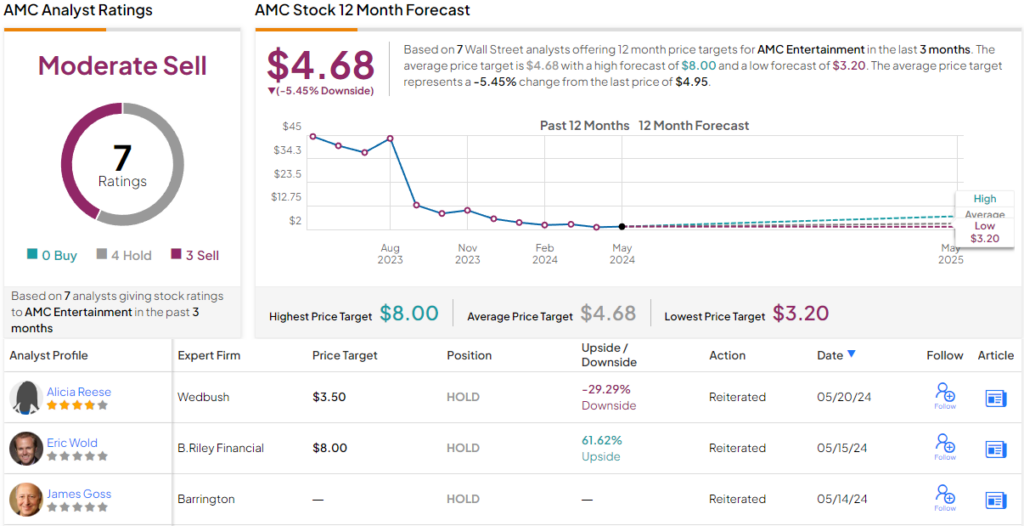

Avoidance also appears to be the conclusion reached by the Street’s analysts. The consensus view is that this stock is a Moderate Sell, based on a mix of 4 Hold ratings and 3 Sells. Going by the $4.68 average target, the shares are set to decline by 5.5% from current levels. (See AMC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.