Shares of State Street (NYSE: STT) were up in morning trading on Wednesday after the financial services company announced that it had mutually agreed with Brown Brothers Harriman & Co. (BBH) to terminate the proposed acquisition of BBH’s Investor Services business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

STT cited regulatory hurdles and a “modified transaction structure” which “was increasingly complex, presented additional operational risk to State Street and would limit the anticipated transaction benefits relative to original expectations.”

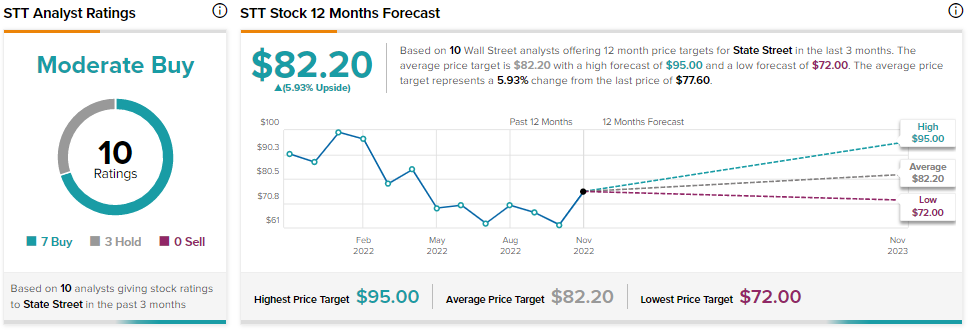

Analysts are cautiously optimistic about STT with a Moderate Buy consensus rating based on seven Buys and three Holds. The average price target for STT stock is $82.20 implying an upside potential of 5.9% at current levels.