Starbucks (NASDAQ:SBUX) may be one of the reigning kings of fast beverage service but it’s been taking a lot of flack for its labor practices. With strikes and lawsuits emerging in ever-growing numbers, it’s not looking any better today. Nevertheless, investors are giving this powerhouse the benefit of the doubt and sending its shares up fractionally in Friday afternoon’s trading.

So what’s going on with Starbucks now? It’s new trouble with the government. Specifically, Arthur Amchan, a judge with the National Labor Relations Board (NLRB), noted that Starbucks’ shutdown of a Cornell University-adjacent campus was done mainly as a means to discourage unionization. Starbucks, according to Amchan, could not prove that the store would have been closed “…absent its animus towards the pro-union employees who worked there.” With Starbucks planning to close the three Starbucks locations near Cornell by the end of this year, it was smoking gun enough for Amchan.

That’s just one of the latest problems for Starbucks. With the NLRB also taking aim at Starbucks over its treatment of workers at the Pike Place Market in Seattle, and customers getting irked by price hikes that saw a customer drop $6.17 for a single iced chai tea latte, it’s a lot of trouble coming together all at once. Throw in the recent kerfuffle over Pride decorations at some locations and it’s only one more in a series of hits Starbucks is taking. Troublesome developments, certainly, but investors seem confident that Starbucks can pull through.

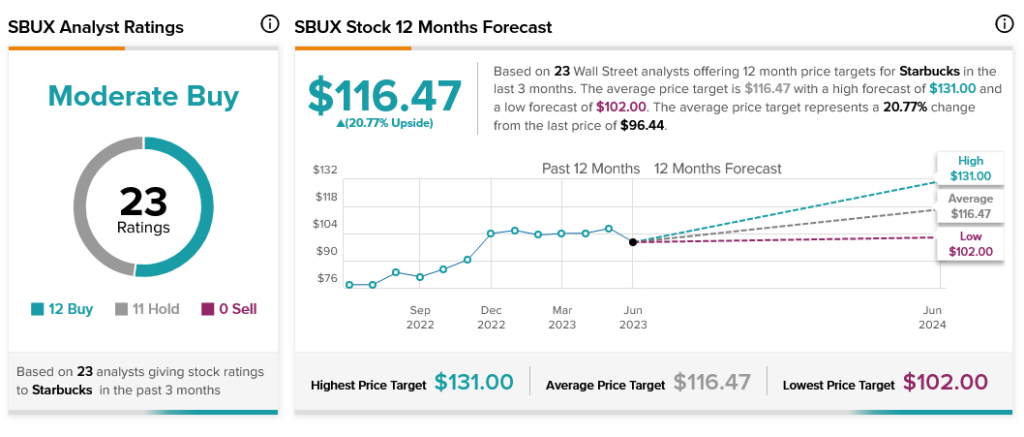

Analysts have a similar hope. Indeed, with 12 Buy ratings against 11 Holds, Starbucks stock is considered a Moderate Buy. Further, with an average price target of $116.47, Starbucks stock also offers investors 20.77% upside potential.