Coffeehouse chain Starbucks (NASDAQ:SBUX) gained in pre-market trading after the company reported adjusted earnings of $1.00 per share for its third quarter of FY23, up by 19% year-over-year. This was above analysts’ consensus estimate of $0.95 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s sales in the third quarter were $9.2 billion, an increase of 12% year-over-year versus analysts’ expectations of $9.29 billion. Starbucks’ global comparable store sales increased 10% in the third quarter.

Rachel Ruggeri, Starbucks’ CEO commented, ““I am pleased with our third quarter performance, which beat our expectations, including our International segment. Our performance was bolstered by the progress we are making against our strategies, specifically our Reinvention Plan, and its unfolding into tangible financial results.”

The company is expected to provide its FY23 guidance on its Q3 earnings call.

What is the Future Price of SBUX Stock?

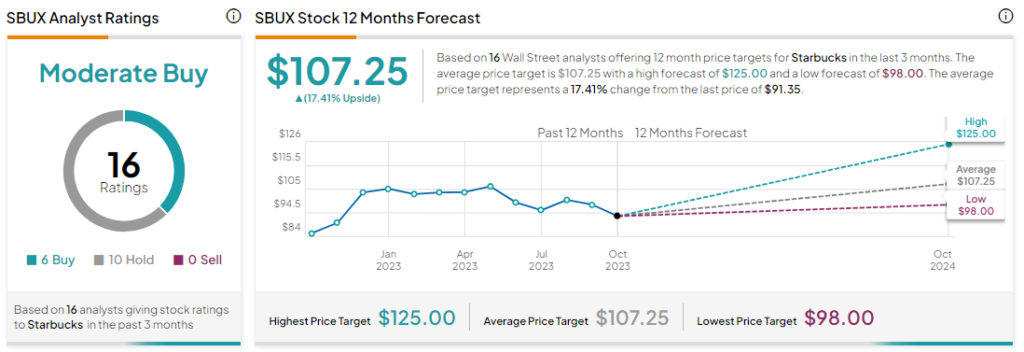

Analysts are cautiously optimistic about SBUX stock with a Moderate Buy consensus rating based on six Buys and 10 Holds. The average SBUX price target of $107.25 implies an upside potential of 17.4% at current levels.