Standard Chartered (SCBFF) subsidiary SCBSL has entered into an initial shareholders’ agreement with BetaPlus for their joint venture (JV) SC Bank Solutions. Under the terms of the agreement, SCBSL will own 60% of the issued and paid share capital of SC Bank Solutions, while BetaPlus will own the remaining 40%.

Together with its subsidiaries, Standard Chartered provides banking products and services in Asia, Africa, Europe, the Americas, and the Middle East.

Markedly, SCBSL and BetaPlus are to contribute a S$240-million aggregate amount to SC Bank Solutions. SCBSL is tasked with raising S$144 million of the aggregate amount, out of which S$90 million should come before the agreement is completed. BetaPlus, on the other hand, is to contribute S$96 million.

The total amount of S$240 million is to finance SC Bank Solutions’ business according to the agreed business plan. Additionally, on and from the fifth anniversary, BetaPlus can push SC Bank Solutions to buy back its stake in the joint venture at the fair market value. (See Standard Chartered stock charts on TipRanks)

The ownership agreement comes on the heels of SC Bank Solutions securing a full banking license from the Monetary Authority of Singapore. The joint venture was set up to provide digital banking services, in response to the digitization of Singapore’s economy.

Notably, the joint venture between SCBSL and BetaPlus brings second Standard Chartered’s licensed digital bank to Asia. The bank also owns Mox Bank Limited, a separate joint venture with operations in Hong Kong.

In August, Deutsche Bank analyst Robert Noble reiterated a Buy rating on the stock with a $7.34 price target, implying 17.28% upside potential to current levels.

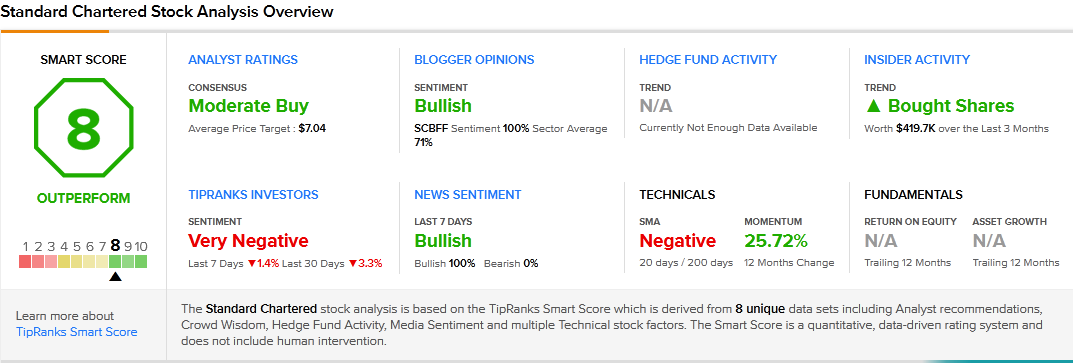

Consensus among analysts is a Moderate Buy, based on three Buys, two Holds, and one Sell. The average Standard Chartered price target of $7.04 implies 12.6% upside potential to current levels.

SCBFF scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

State Street to Snap up Brown Brothers’ Investor Services Business for $3.5B

Mastercard to Snap Up Aiia; Street Says Buy

JD.com to Acquire Stake in China Logistics