Stablecoin giant Circle (CRCL) is looking at ways to make USDC transactions reversible. President Heath Tarbert said the company is exploring “whether or not there’s the possibility of reversibility of transactions” while still aiming for final settlement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Circle’s upcoming Arc blockchain would not roll back transfers at the base layer. Instead, the plan is to let users trigger refunds or counter-payments on top, especially in cases of fraud or disputes.

Why Circle Wants This

The goal is to make USDC friendlier to banks and regulators. In traditional finance, reversibility is built into the system through chargebacks and refunds. Crypto has rejected that idea, leaning on the principle that once a transaction is made, it cannot be undone.

Circle is trying to strike a middle ground. Arc is designed to keep the efficiency of blockchain while layering in protections that institutions expect.

What Investors Should Look Out For

If Circle pulls this off, stablecoin adoption could accelerate in payments, banking, and cross-border settlements. Reversibility makes USDC behave more like dollars in a bank account, which could encourage new inflows from conservative institutions.

But this also raises questions. Who decides when a transaction can be reversed? What does this mean for censorship resistance? And will crypto purists abandon USDC if they think its neutrality is compromised?

For investors, the trade-off is clear: more regulatory comfort and more capital entering stablecoins, but at the cost of decentralization.

There Are Risks to Changing the Rules

Reversibility comes with economic and technical risks. Giving users the sense that transfers can be undone creates moral hazard. It may reduce the certainty that underpins blockchain settlement.

Technically, Circle must build governance and dispute mechanisms without slowing down the system or making it too centralized. Critics warn this could turn Arc into a semi-traditional payments network dressed up as a blockchain.

Stablecoins Move Toward Traditional Finance

Circle has been racing to expand USDC’s role in mainstream finance. With over $700 million in circulation, the token already anchors DeFi pools and cross-border transfers. Adding reversibility would push it further into the territory of regulatory-compliant money.

This experiment could change how investors think about stablecoins. Instead of choosing between wild-west decentralization and rigid fiat rails, Arc may offer a hybrid model, which could be blockchain speed with finance-style safeguards.

Is CRCL Stock a Good Buy?

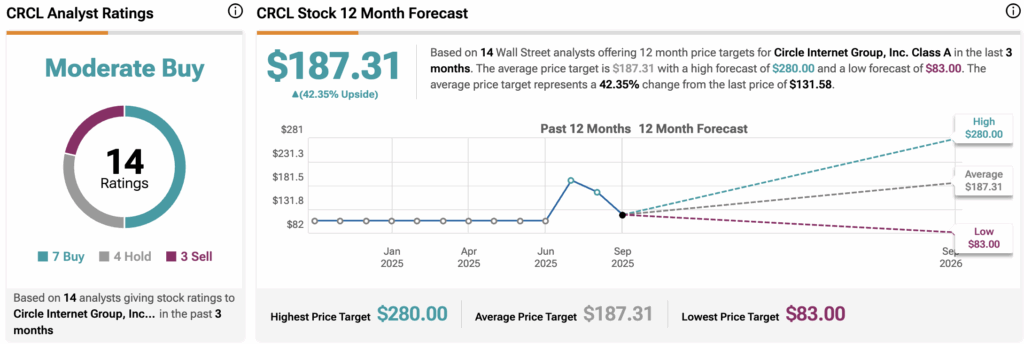

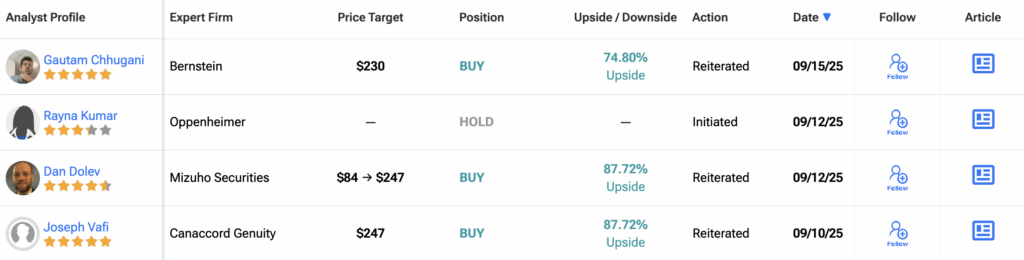

Wall Street remains divided on Circle Internet Group (CRCL). Out of 14 analysts covering the stock over the past three months, seven rate it a Buy, four suggest a Hold, and three recommend a Sell. This mix gives the stock an overall Moderate Buy consensus.

The average 12-month CRCL price target comes in at $187.31, which implies a potential 42.35% upside from the current price.