Shares of Australian gold miner St Barbara Ltd. (ASX:SBM) jumped today, rising more than 9%. The stock’s surge can be linked to the continued rally in gold prices, which overnight soared the most since March.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors are purchasing gold amid growing fears that central banks’ ongoing interest rate rises across the globe will cause a recession. A decline in bond yields has also sent some investors seeking shelter in the precious metal. Gold is considered a safe haven asset, and its demand tends to increase in times of economic uncertainty.

Other ASX gold miner stocks rising alongside St Barbara shares were Newcrest Mining (ASX:NCM) and Northern Star (ASX:NST). St Barbara shares are still down more than 45% from where they began the year.

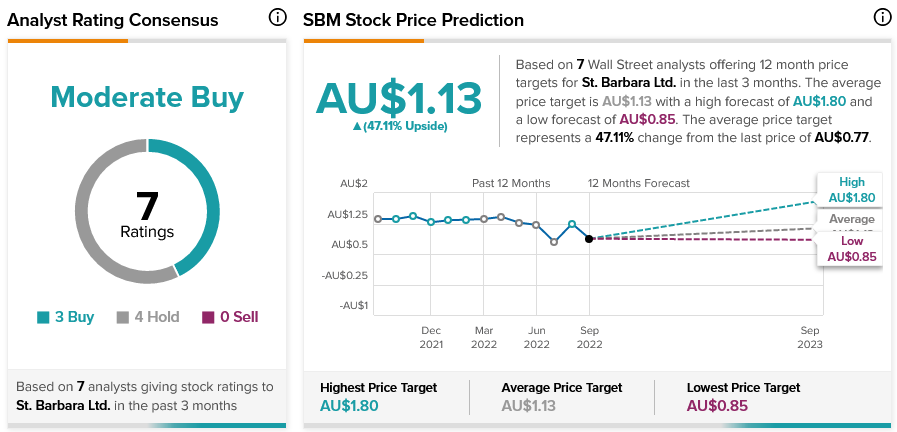

St Barbara share price forecast

According to TipRanks’ analyst rating consensus, St. Barbara stock is a Moderate Buy based on three Buys and four Holds. The average St Barbara price forecast of $1.13 indicates over 47% upside potential.

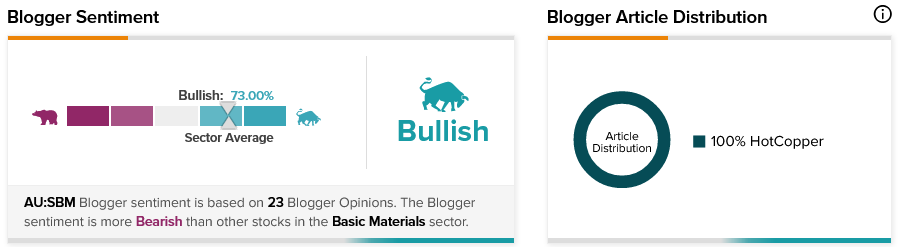

St Barbara stock is receiving favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 73% Bullish on St Barbara, compared to a sector average of 74%.

Closing thought

While interest rates look set to raise further in the short term, gold prices remain less certain. TipRanks insights can help investors choose gold mining stocks that have the ability to ride out market volatility, and deliver positive returns.