Shares of Squarespace (NYSE: SQSP) surged over 10% in pre-market trading on Tuesday even as the website building and e-commerce platform reported a loss of $1.72 per share versus a loss of $0.12 in the same period. However, this loss widened in the fourth quarter due to a “non-cash goodwill impairment charge of $225.2 million primarily due to market values deteriorating subsequent to our acquisition of Tock in March 2021.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Total revenues increased by 10% year-over-year to $228.8 million surpassing consensus estimates of $222.08 million. Total bookings grew 15% year-over-year to $232.1 million.

Looking forward, management now expects to clock revenues in the range of $232 million to $234 million versus a consensus of $227.64 million and between $955 million and $970 million versus estimates of $947.7 million in Q1 and FY23, respectively.

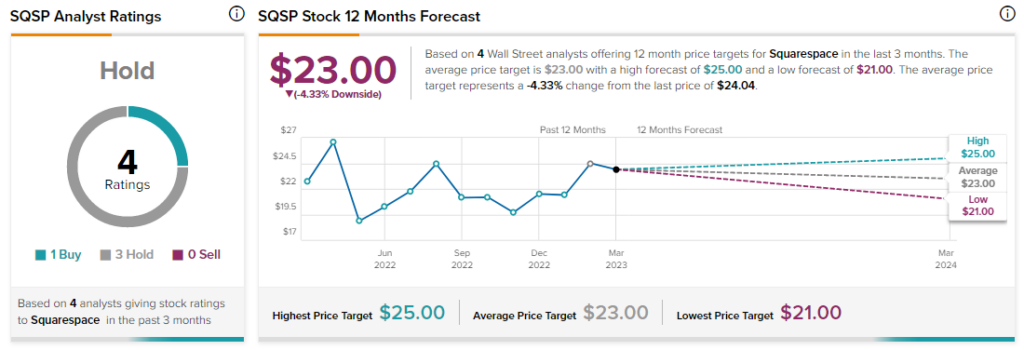

Overall, Wall Street analysts are sidelined about SQSP stock with a Hold consensus rating based on one Buy and three Holds.