SPX Technologies (NYSE: SPXC), the supplier of infrastructure equipment and technologies announced adjusted earnings of $0.93 per share in Q1 versus $0.40 in the same period last year and above analysts’ expectations of $0.60 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In Q1, SPXC posted revenues of $399.8 million, up by 30.2% year-over-year, beating analysts’ expectations of $331.13 million.

Looking forward, management also raised its FY23 guidance. Gene Lowe, President and CEO, of SPX Technologies commented, “Based on strong first quarter performance, continued robust demand, and the acquisition of TAMCO, we are increasing our guidance for full-year 2023 Adjusted EPS to a range of $3.80 to $3.95 [above the consensus estimate of $3.49 per share], a year-on-year increase of 25% at the midpoint.”

In FY23, SPX is projecting revenues between $1.61 billion and $1.65 billion from prior guidance in the range of $1.50 to $1.54 billion and ahead of consensus estimates of $1.53 billion.

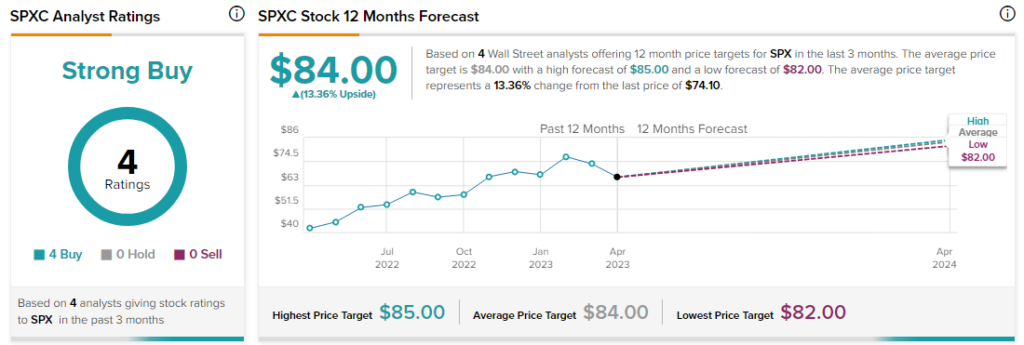

Overall, Wall Street analysts are bullish about SPXC stock with a Strong Buy consensus rating based on four unanimous Buys.