Spruce Biosciences (SPRB) is on one of the most dramatic runs in biotech this year. Shares have surged nearly 2,900% over the past week, reaching $234.74 in Tuesday trading. The stock gained another 80% today alone, extending a rally sparked by major regulatory news from the U.S. Food and Drug Administration.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Trading has been volatile, with multiple pauses for volatility since Monday’s session, as investors rushed to price in new optimism about the company’s lead therapy. The surge highlights how quickly sentiment can shift in the microcap biotech space, where clinical breakthroughs can redefine a company’s outlook overnight.

FDA Grants Breakthrough Therapy Designation

The rally began after Spruce announced that its lead drug candidate, tralesinidase alfa enzyme replacement therapy (TA-ERT), received Breakthrough Therapy Designation from the FDA. The treatment targets Sanfilippo Syndrome Type B (MPS IIIB), an ultra-rare genetic disorder that affects the brain and spinal cord and has no effective therapy today.

The designation gives Spruce’s program priority access to regulators and allows for an accelerated review process, which is an important milestone for a small company racing toward commercialization. The company said it plans to submit a Biologics License Application in the first quarter of 2026.

“We are pleased to receive U.S. FDA Breakthrough Therapy Designation as we prepare to submit the Biologics License Application of TA-ERT for the treatment of MPS IIIB in the first quarter of 2026,” said CEO Javier Szwarcberg.

Rare-Disease Focus Draws Investor Attention

Spruce’s work focuses on therapies for neurological and genetic conditions with limited treatment options. The company’s success in securing Breakthrough status positions it among a small group of biotech firms advancing potential first-in-class therapies for rare diseases.

Analysts note that such designations often act as catalysts for sustained investor interest. Beyond the initial excitement, they give companies better odds of partnership discussions, early funding, and visibility with large pharmaceutical players.

Risk and Reward Still Run High

Despite the historic rally, Spruce remains a clinical-stage biotech with no approved products or revenue. The company will need to raise additional capital to fund its manufacturing and commercialization plans. Biotech veterans caution that even promising therapies can face setbacks during large-scale trials or manufacturing review.

Still, the scale of the move tells us how investors value regulatory momentum in rare-disease development.

Is Spruce Biosciences a Good Buy?

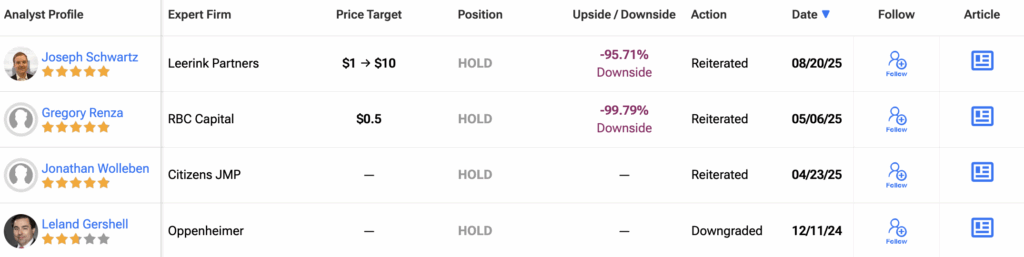

Despite the historic rally, Wall Street sentiment on Spruce Biosciences (SPRB) remains muted. The sole analyst covering the stock currently rates it a Hold, with no Buy or Sell recommendations issued in the past three months.

The average 12-month SPRB price target sits at $10.00, implying a 95.65% downside from the stock’s recent trading level.