Shares of the enterprise software company Sprinklr (NYSE:CXM) are up more than 78% year-to-date, reflecting its strong subscription revenues and operational efficiencies. Further, the company remains upbeat and expects the momentum in subscription revenues to sustain in the coming years. Based on analysts’ 12-month average price, the stock offers double-digit upside potential from current levels.

Momentum in Business to Sustain

During its 2023 Investor Day, which was held on July 12, the company announced that it expects to generate $1 billion in subscription revenue by 2027. Platform and product expansion driven by AI (Artificial Intelligence) will likely support its growth.

Further, its growing customer base and increased number of customers adopting multiple product suites augur well for growth. Also, the company has a strong backlog, which will drive future revenues.

Its subscription revenues have grown at a CAGR of 25% from Fiscal 2020 to Fiscal 2023. Meanwhile, all of its products have delivered double-digit growth during the same period. In addition, the number of customers with multiple product suites (at least four) has risen from 105 in Fiscal 2020 to 228 in Fiscal 2023.

Also, customers with over $1 million in revenues have grown to 108 in Fiscal 2023 from 49 in Fiscal 2020.

While its top line is expected to increase, operational efficiencies will drive operating income and free cash flows. The company expects its free cash flow margin to reach 20% in Fiscal 2027 from 2% in Fiscal 2023.

Analysts Weigh In

Following the management’s medium-term guidance update at its Investor Day, Raimo Lenschow of Barclays reiterated a Buy on CXM stock. The analysts’ price target of $16 implies 9.74% upside potential from current levels.

Oppenheimer analyst Brian Schwartz said that the company’s “AI-embedded platform suite of solutions remains best-in-class for enterprise customers.” He added that Sprinklr, with its next-gen technologies, “is widening its leadership position in CCaaS (contact center as a service) end-markets.” However, the analyst reiterated a Hold on CXM stock as he sees execution risk.

Is CXM a Good Buy?

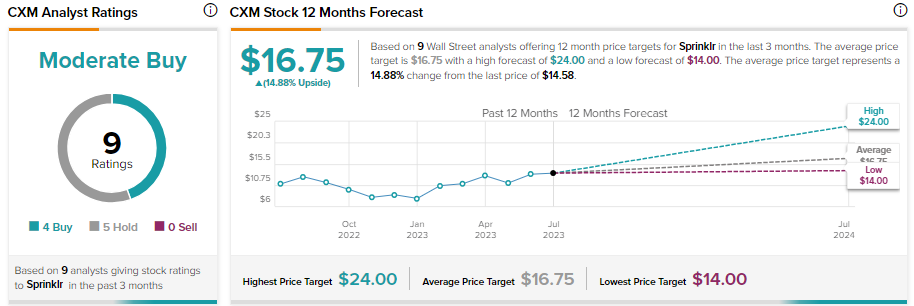

CXM stock has four Buy and five Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $16.75 implies 14.88% upside potential from current levels.