Spotify (NYSE:SPOT) reported earnings results for its third quarter of Fiscal Year 2022. Earnings per share came in at -€0.99, which missed analysts’ consensus estimate of -€0.85 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased 21.6% year-over-year, with revenue hitting €3.04 billion compared to €2.50 billion. This was higher than the consensus estimate by €20 million. It’s also worth noting that monthly active users increased by 20% on a year-over-year basis to 456 million, which was 6 million more than expected.

However, this growth did not come cheap. Indeed, the company demonstrated significant operating deleverage since its operating margin contracted from 3% to -7.5%. Furthermore, the gross margin decreased from 26.7% to 24.7%.

As a result, the company’s operating income fell from €75 million in the comparable period to -€228 million now.

Is SPOT Stock a Good Buy?

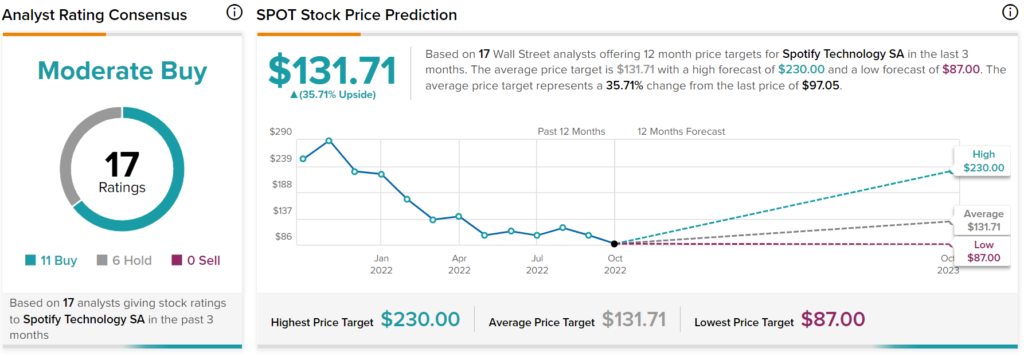

Spotify has a Moderate Buy consensus rating based on 11 Buys, six Holds, and zero Sells assigned in the past three months. The average SPOT stock price target of $131.71 implies 35.71% upside potential.