Music streaming giant Spotify (NASDAQ:SPOT) is on a roll in Tuesday morning’s trading. It was up over 12% at one point, thanks to good news from its earnings report and from analysts who are taking increased notice of a service that some thought was on its way out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The good news started with the earnings report. Spotify’s third quarter revenue was up nearly 11% against 2022’s third quarter, reaching 3.36 billion euros. With Bloomberg estimating 3.33 billion, that was a clear win. Meanwhile, monthly active users were also on the rise, up 26% against 2022’s third quarter.

Ultimately, Spotify brought in around 574 million users total, which is up 4% just from last quarter. Bloomberg estimates looked for just 572.31 million, so another win for Spotify. In addition, ad-supported monthly active users, revenue per monthly active user, and just everything in general was up for Spotify.

This leads us to the next bit of good news. All those wins in one place caught analyst attention at Bank of America. It left its Buy rating in place and also kept its $185 price target in place thanks to the sheer amount of improvement Spotify is showing. Further, Bank of America analysts look for advertising to improve, along with revenue and expenses.

Is Spotify a Buy, Hold, or Sell?

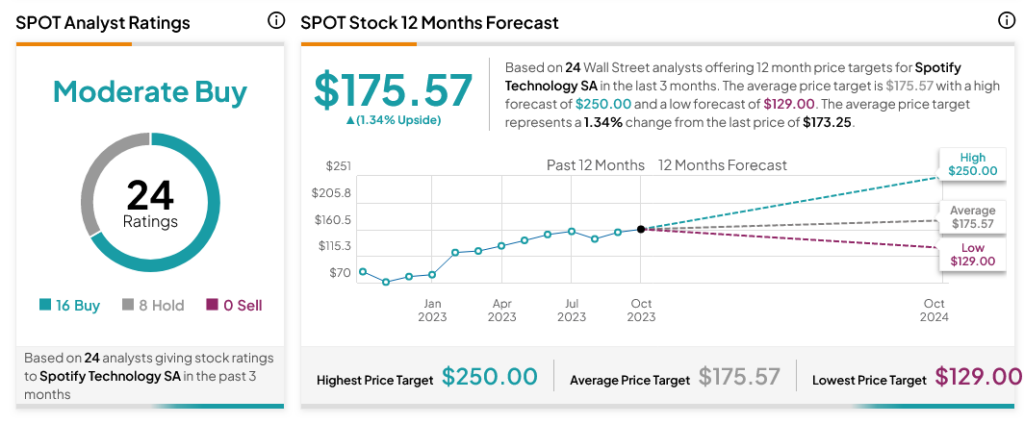

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SPOT stock based on 16 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPOT price target of $175.57 per share implies 1.34% upside potential.