There’s good news for music streamer Spotify (NASDAQ:SPOT), and its users, in Monday’s trading. Spotify is up fractionally as a new report from Monness, Crespi, Hardt revealed that Spotify is still growing. That in turn should keep its cash flow figures in good spirits.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Monness report, via analyst Brian White, noted that growth at Spotify has been “surprisingly strong.” Spotify has surpassed its monthly active user (MAU) figures for the last two quarters, and now, White expects the streamer to post a combined total of 217 million premium subscribers this quarter. That would represent a 16% increase. Meanwhile, total monthly active users will hit 532 million, up 23% in turn. All of those gains should mean more revenue, and White is looking for an extra 12% against this time last year, hitting over 3.2 billion euros. That’s not as good of news as you might think, though, as analysts were looking for 3.48 billion euros in revenue anyway.

The news also comes at a time when more competition is stepping in. TikTok recently started showing new charts to its users, the “Viral” and “Hot 50” charts, to see trending songs and add tracks to videos. Further, two more markets picked up the TikTok Music streaming app, which could put some extra strain on Spotify in other markets.

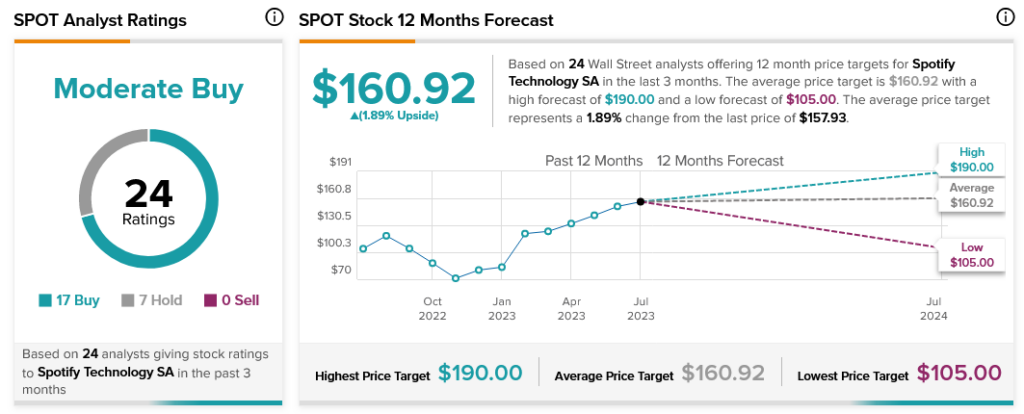

Despite growing competition, however, analysts are mostly on Spotify’s side. With 17 Buy ratings and seven Holds, Spotify stock is considered a Moderate Buy. However, with an average price target of $160.92, Spotify can only muster a paltry upside potential of 1.89%.