Shares of music streaming giant Spotify (SPOT) pared back gains from Tuesday’s pre-market trading, falling more than 5% at the start of regular trading. This came despite the company’s third-quarter earnings report exceeding Wall Street’s forecasts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Spotify Beats Wall Street

During the quarter, the Stockholm-based company earned $3.78 per share, more than double the $1.67 in the same period last year and comfortably beating analysts’ expectations of $2.25. Similarly, the streaming platform’s revenue jumped 7% YoY to $4.9 billion, slightly surpassing analysts’ consensus of $4.86 billion.

Furthermore, Spotify provided comfort to investors in other areas: its gross margin came in 50 basis points ahead of guidance, reaching 31.6%. This is even as the streaming platform’s monthly active user base expanded by 11% to 713 million, with premium subscribers growing in close measure to 281 million.

‘The Business Is Healthy,’ Says Spotify’s CEO

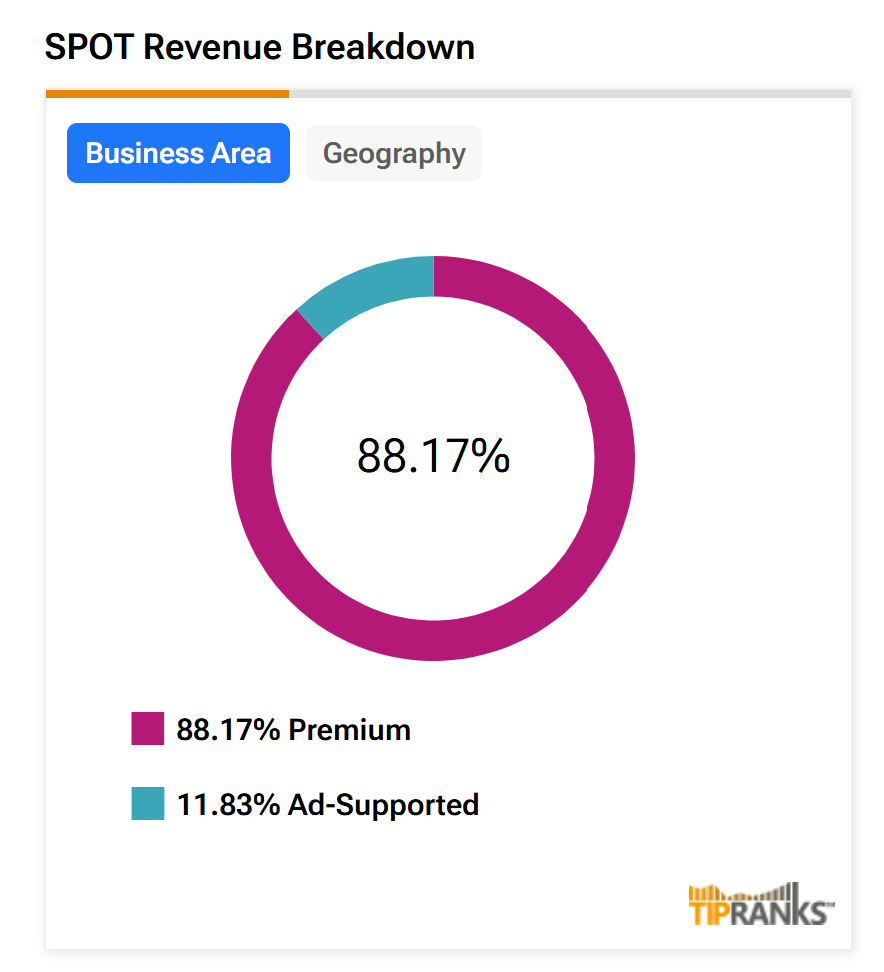

In terms of revenue, premium subscriptions accounted for about 90% of its sales during the recent quarter, with ad-supported subscriptions accounting for the rest. Spotify’s operating income also rose by 28% to €582 million ($608 million).

Heading into the results, Wall Street expected Spotify’s pricing strategy to drive its growth. Daniel Ek, the company’s founder and CEO, believes that this factor, along with others, remains in the company’s favor.

“The business is healthy. We’re shipping faster than ever,” Ek noted, adding that Spotify has “the tools [it needs] — pricing, product innovation, operational leverage, and eventually the ads turnaround.”

Spotify Raises Outlook

For its subsequent quarter, Spotify expects its monthly active users to reach 745 million, with 32 million added during the period. It also predicts its premium subscribers to reach 289 million, adding 8 million new accounts — minus those who exit the platform.

However, the Swedish audio streaming giant’s revenue projection is more cautious. It anticipates its total revenue rising by about 6% to €4.5 billion ($5.2 billion) in the next quarter.

Growth in its gross profit margin and operating income is also expected to be in the low single-digit territory by the end of its ongoing quarter. Gross margin is expected to rise 4% to 32.9%, with operating income adding about 7% to reach €620 million ($714 million).

Is SPOT Stock a Good Buy?

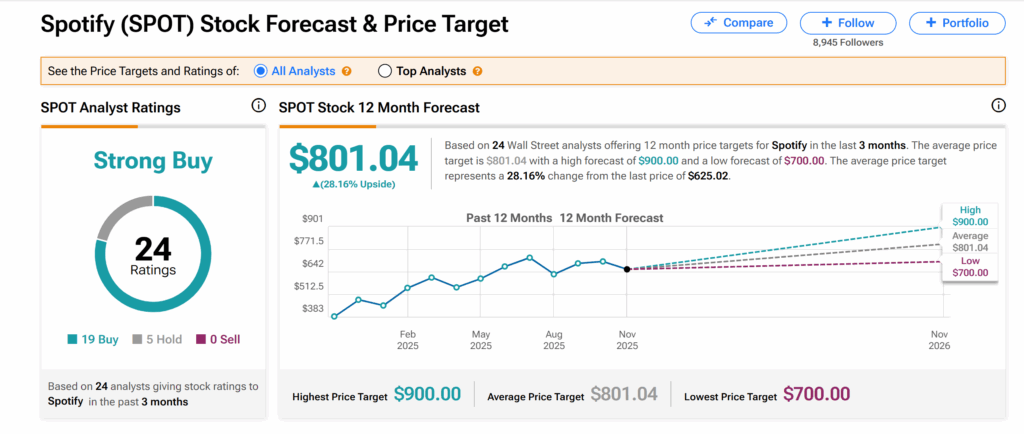

Turning to Wall Street, Spotify’s shares continue to enjoy a Strong Buy consensus rating from analysts, according to TipRanks. This is based on 19 Buys and five Holds issued by 24 analysts over the past three months.

Moreover, the average SPOT price target of $801.04 indicates a 28% upswing.