In what may be the strangest turnaround ever, Virgin Galactic (NYSE:SPCE) successfully launched the Galactic 01 mission, officially welcoming a whole new era of space tourism, of which it’s pretty much the front-runner. And in the process, Virgin Galactic stock plunged over 10% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Granted, Galactic 01 was not exactly a sweeping epic. It took two Italian Air Force colonels and one aerospace engineer into space, along with the spacecraft’s two pilots and a Virgin Galactic instructor. But still, the Unity spaceplane—Virgin Galactic’s main spacecraft—departed from the back of the VMS Eve transport jet at 50,000 feet and then got itself into full-on space, 279,000 feet up from the Earth’s surface.

It took nearly two decades to get Virgin Galactic to this point, and there’s already been substantial interest in future flights. Virgin Galactic has already sold 600 tickets at prices around $250,000 and also has sold another couple hundred on top of that at an upgraded price of $450,000 per ticket. Yet there’s no denying that Virgin Galactic, even with those prices, has been hemorrhaging cash for years. There are also some unpleasant legal questions surrounding space travel in the United States; for the most part, it’s self-regulated. Congress, according to the Federal Aviation Administration, already has a moratorium in place on commercial spaceflight regulations going back to 2004 and will continue through this year.

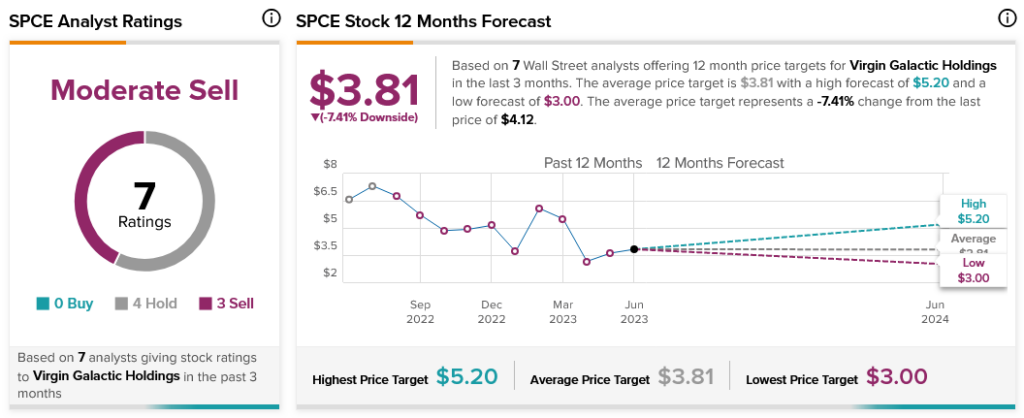

Virgin Galactic also isn’t doing well with analysts. With four Hold and three Sell ratings, Virgin Galactic stock is considered a Moderate Sell. Further, with an average price target of $3.81, Virgin Galactic stock offers a downside risk of 7.41%.