S&P Global (SPGI) is officially entering the crypto market. The company said Tuesday it will introduce the S&P Digital Markets 50 Index, a new benchmark designed to track both leading cryptocurrencies and publicly traded companies tied to the digital asset economy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The index will include 15 major cryptocurrencies and 35 crypto-related stocks, offering exposure to both sides of the industry in a single framework. It is being developed in collaboration with Dinari, a tokenization firm that plans to make the index investable through its on-chain “dShares” tokens.

The move shows how digital assets are becoming a recognized part of the broader financial system rather than a speculative niche.

S&P Builds a Path to Mainstream Adoption

S&P said the Digital Markets 50 will follow its standard rules-based governance model, including quarterly rebalancing and strict eligibility criteria. To qualify, cryptocurrencies must have a market capitalization of at least 300 million dollars, while public companies must meet a 100 million dollar minimum.

No single component will represent more than 5% of the index, a measure designed to control volatility and prevent overexposure to Bitcoin or any single equity.

By blending crypto assets and traditional stocks, S&P aims to create a product that institutions can use to benchmark or gain diversified exposure to the digital economy.

The Move Boosts Bitcoin’s Mainstream Momentum

The launch of a Bitcoin-inclusive index under the S&P banner is a milestone moment for digital assets. It effectively places Bitcoin within the same analytical and financial frameworks that govern traditional markets, from ETFs to mutual funds.

For institutional investors, the index could serve as a familiar reference point that bridges regulated finance and emerging blockchain markets. The development also reflects how major financial players are shifting toward greater integration of tokenized assets, custody services, and blockchain infrastructure.

Analysts Flag Risks as Index Expands

Analysts caution that crypto’s volatility remains a challenge. Even with asset caps and regular rebalancing, the performance of the new index could swing widely in short time frames.

Regulatory clarity also remains a key factor. While S&P’s involvement adds credibility, bringing a tokenized index into the U.S. market will require navigating complex oversight around securities and digital assets.

S&P Prepares for Crypto Rollout

S&P has not yet announced the official launch date, but early indications suggest that the index could go live later this year. Market watchers are now waiting to see which cryptocurrencies and stocks will be included in the first basket.

If successful, the S&P Digital Markets 50 could become the most significant step yet in linking Wall Street with the crypto economy and giving Bitcoin and its peers a permanent seat at the financial table.

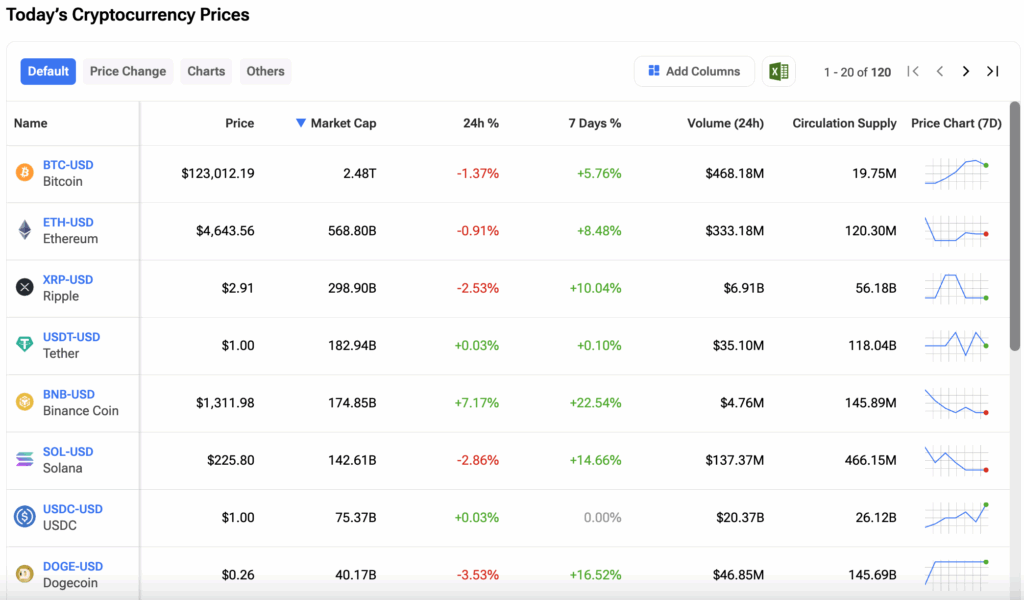

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.