The S&P 500 (SPX) took a beating today after DeepSeek slammed tech and artificial intelligence (AI) stocks. DeepSeek released new AI models over the weekend that showed impressive performance and efficiency, matching or overtaking the capabilities of the biggest AI models from U.S. companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This hammered AI stocks today as investors lost confidence in the businesses behind them. That’s due to the cheap development of DeepSeek and its open-source release. This allows anyone to use or modify the AI, potentially eating into other AI companies’ profits.

With the damage DeepSeek has done to AI stocks today, it should come as no surprise that the SPX isn’t performing well, either. This has the index down 1.78% as of this writing, taking a chunk out of its 3.73% increase year-to-date.

What Stocks Are Hitting the S&P 500 the Hardest?

Turning to TipRanks’ SPX heatmap tool, traders will see which stocks are harming the index the most today. Nvidia (NVDA) and Broadcom (AVGO) are easily the two companies with the biggest influence on the S&P 500 today with 14.88% and 15.16% drops, respectively. Oracle (ORCL), Alphabet (GOOGL), and Amazon (AMZN) aren’t helping the index with falls today.

How to Invest in the S&P 500

Investors can’t take a direct stake in the S&P 500 as it’s only an index. Instead, they might consider buying shares of stocks listed on it. Traders who believe Nvidia and Broadcom can recover from today’s DeepSeek damage might see today’s dips as strong entry points.

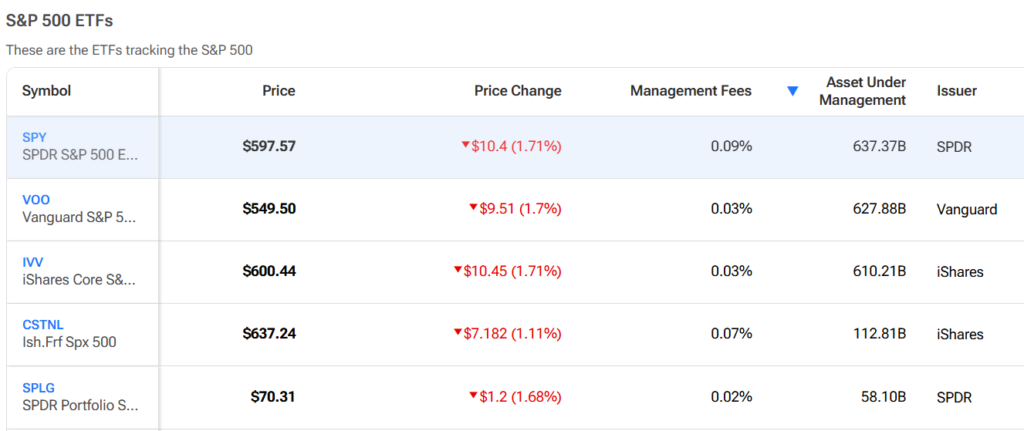

Another option for investors is buying shares of an exchange-traded fund (ETF) that tracks the SPX, including those betting on or against the index. SPDR S&P 500 ETF Trust (SPY) is one popular choice but other ETFs are available.