Southwestern Energy (SWN) has reached a $2.7 billion deal to acquire Indigo Natural Resources. Under the terms of the agreement, the company will pay $400 million in cash and about $1.6 billion in common stock. The remaining $700 million will come in the form of 5.375% senior notes due 2029. The transaction is expected to close in Q4.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The acquisition of the privately held natural gas producer should enhance the company’s position as a leader in natural gas production while complimenting the existing portfolio. Southwestern Energy also stands to gain access to low-cost premium markets in the Gulf Coast LNG corridor.

Additionally, the transaction is expected to increase Southwestern’s free cash flow to about $1.2 billion from 2021 to 2023. (See Southwestern Energy analysis on TipRanks).

“Indigo has done a terrific job building its business, and its balance sheet strength, low cost structure and high-quality acreage position in the core of the Haynesville play accelerates the delivery of our strategic goals,” said Southwestern Energy CEO Bill Way.

Following the acquisition, Southwestern Energy will operate a four rig program in 2022, placing 30 to 40 wells to sales. Some of the synergies from the transactions include about $20 million in G&A reductions. The natural gas producer also expects operational and financial cost savings.

In May, Mizuho Securities analyst Vincent Lovaglio reiterated a Hold rating on the stock. The analyst also increased the price target to $6 from $5, implying 7.53% upside potential to current levels.

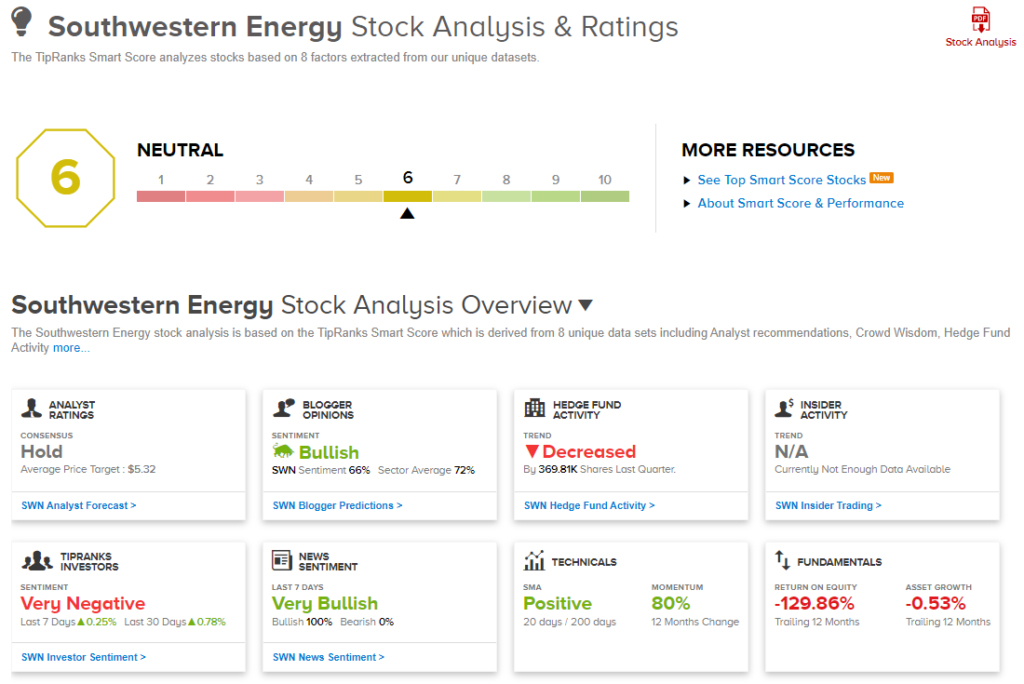

Consensus among analysts is a Hold based on 2 Buys, 5 Holds, and 2 Sells. The average analyst price target of $5.32 implies 4.66% downside potential to current levels.

SWN scores a 6 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

Kinder Morgan to Snap up Stagecoach Gas for $1.2B

SS&C Technologies Raises Mainstream Buyout Offer Again

Moderna Inks COVID-19 Vaccine Production Agreement with Lonza