It would be easy to think that divesting businesses would be a fairly smart move. For natural gas company Southwest Gas (NYSE:SWX), that’s not the case. The company is down substantially in Thursday afternoon trading after the details of its divestitures emerged.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move featured Southwest Gas selling its MountainWest pipelines to Williams Companies Inc. (NYSE:WMB). Williams, in turn, agreed to pay $1.07 billion for the pipelines in question. Southwest Gas also noted that it would spin off its utility infrastructure services operation, known as Centuri. The company first announced that plan back in March, so it’s been a long time coming.

Southwest’s sale started back in 2021 when its purchase of Questar Pipelines—which subsequently became MountainWest—sparked a proxy war that lasted months. The $2 billion purchase of Questar incensed investor Carl Icahn so much that he moved to replace the board. In the process, Icahn landed three new seats on Southwest’s board. It also yielded the removal of John Hester, the company’s former CEO.

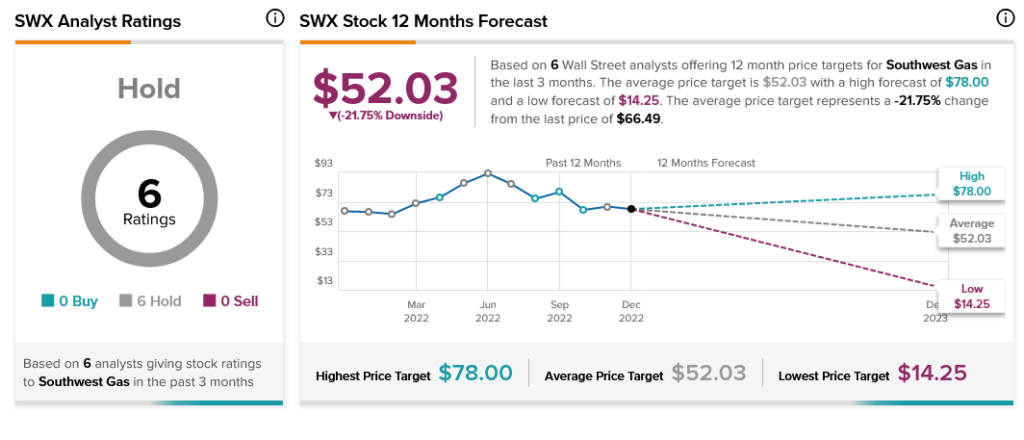

The move, in general, has not proven especially welcoming for Southwest investors, nor for the analysts that follow it. Currently, analysts’ consensus on Southwest is a Hold, with six Hold recommendations and not a Buy or Sell among them. The company also has 21.75% downside risk, thanks to the average price target of $52.03.