Good news for air travelers as airline stock Southwest Airlines (NYSE:LUV) is close to finishing up its labor negotiations. It was the last major airline to wrap up its labor talks, and it’s a process that’s taken months to complete. But with a conclusion finally at hand, the mood is lightening, and investors are happy as well. That much was clear, with Southwest up over 3.5% in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new agreements are mostly in place, at last report. Pay scales, retirement figures, and other matters have been hashed out to both sides’ relatively mutual satisfaction. Now, the only issue left is a schedule of implementation, though neither the pilots’ union nor Southwest itself would discuss any specifics around the deal.

A ratification vote will likely follow over the next few weeks. If the status quo holds, then Southwest will likely be able to get through the holidays without any serious incident. At least as far as the pilots themselves are concerned. The agreement should be fairly generous, though; earlier reports pegged a deal with the flight attendants’ union that featured a 36% pay hike for cabin crew.

Desperate To Not Repeat History

The good news for Southwest, and by extension, its investors, is that this is a major step forward toward preventing what happened last holiday travel season. Most of us likely remember that surprise blizzard on Christmas Eve that shut down even local travel plans for many and wreaked havoc on Southwest’s own systems. Between staffing shortages and its IT troubles, Southwest was effectively crippled in the face of that massive winter storm.

But not this time; Southwest has put over $1 billion into improvements to try and keep its systems up and running. It’s augmented its “winter infrastructure,” as well as its employee scheduling and communication among different workgroups. It may not be able to do anything about the weather, but it’s certainly made progress.

Is Southwest a Buy, Sell, or Hold?

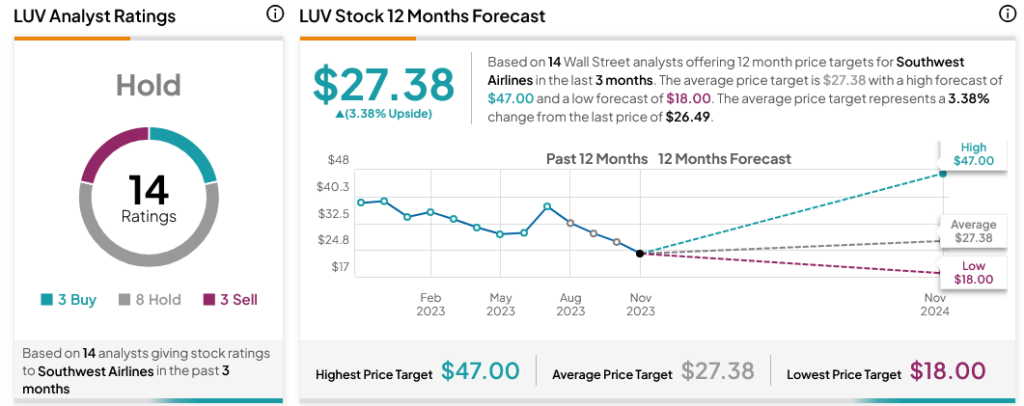

Turning to Wall Street, analysts have a Hold consensus rating on LUV stock based on three Buys, eight Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 31.85% loss in its share price over the past year, the average LUV price target of $27.38 per share implies 3.38% upside potential.