Southwest Airlines (NYSE:LUV) has reached a tentative deal worth $12 billion with its pilots union, the Southwest Airlines Pilots Association (SWAPA). The deal comes in response to the pilots’ demand for substantial pay raises amid a global pilot shortage following the COVID-19 pandemic-induced layoffs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Under the agreement, pilots will receive a 50% pay increase over the next five years. More than 10,000 pilots represented by SWAPA are expected to ratify the deal by January 22, 2024.

Delving deeper, the salaries of Southwest pilots will be hiked by 29% next year, followed by 4% annual increases and a 3.25% increase in 2028. Further, the deal includes other benefits such as improved flying schedules, better disability coverage, and increases in retirement benefits.

It is worth mentioning that LUV is the latest airline company to strike a deal with pilots. Earlier this year, Delta Air Lines (DAL), American Airlines (AAL), and United Airlines (UAL) agreed to increase the pay of their pilots by 34% to 46% throughout their new four-year contracts.

Is LUV a Good Buy Now?

The deal comes after the U.S. Department of Transportation imposed the largest-ever fine of $140 million on the company for allegedly breaking consumer protection laws in the last holiday travel period. This, coupled with the considerable pay hikes, might hit Southwest Airlines’ bottom line to some extent.

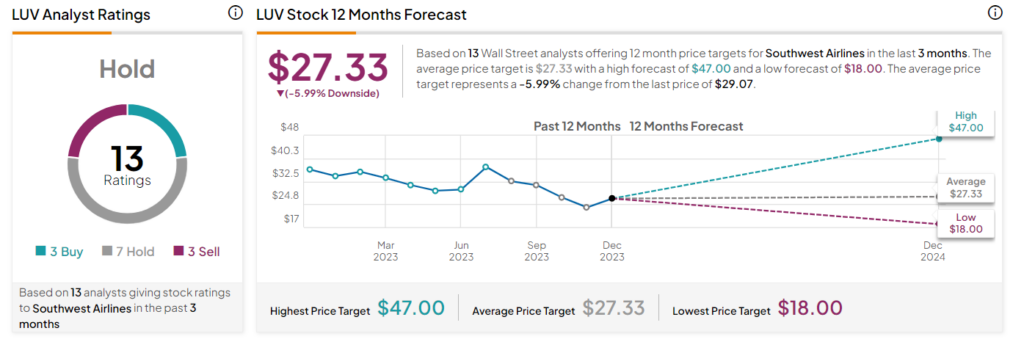

Currently, Wall Street analysts are sidelined on Southwest Airlines stock. It has a Hold consensus rating based on three Buys, seven Holds, and three Sells. The average LUV stock price target of $27.33 implies a 6% downside potential. Shares of the company have declined nearly 12% so far in 2023.