SoundHound AI (SOUN) stock gained momentum after top-rated analyst Scott Buck at H.C. Wainwright raised his price target from $18 to a new Street-high of $26. The upgrade was driven by growing confidence in the company’s long-term growth potential despite the current valuation. Following the upgrade, SOUN stock gained 1.26% in pre-market hours on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, SoundHound AI specializes in voice recognition and natural language processing, offering AI-driven solutions across industries.

Wainwright Stays Bullish on SOUN’s Long-Term Play

Buck reaffirmed his Buy rating on SOUN stock for the long term, noting that the current price is being driven by short-term excitement. The four-star analyst explained that, for now, investors are focused more on market momentum and enthusiasm—so-called “animal spirits”—than on the company’s current valuation. In other words, the recent surge reflects optimism and hype in the short term.

However, he added that over the longer horizon, SoundHound’s actual business growth should provide solid support for the stock. Meanwhile, he pointed to catalysts such as rising demand for the company’s AI-powered services across multiple industries, coupled with a scalable platform that positions the company to expand revenue, improve adjusted EBITDA, and eventually bring earnings in line with its share price.

Moreover, Buck expects SoundHound shares to “materially outperform” in the coming months, with the November Q3 results acting as a potential catalyst.

Is SOUN a Good Stock to Buy?

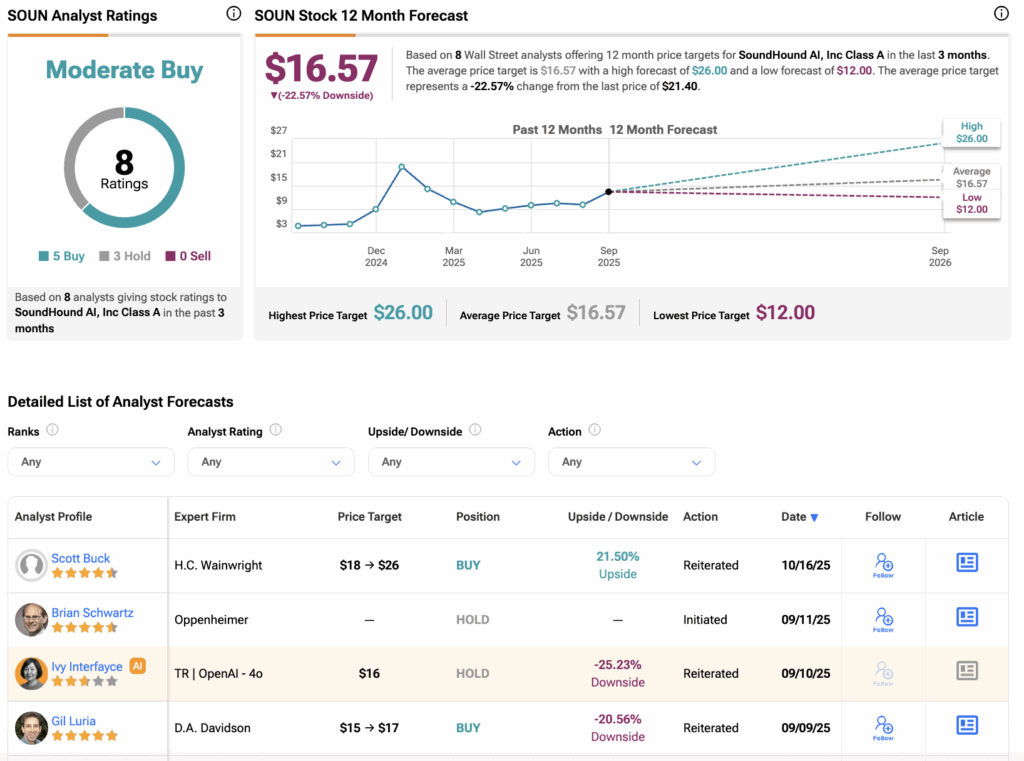

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and three Holds assigned in the last three months. The average SoundHound stock price target is $16.57, suggesting a potential downside of 22.57% from the current level.

SOUN stock has gained 175% over the last six months.