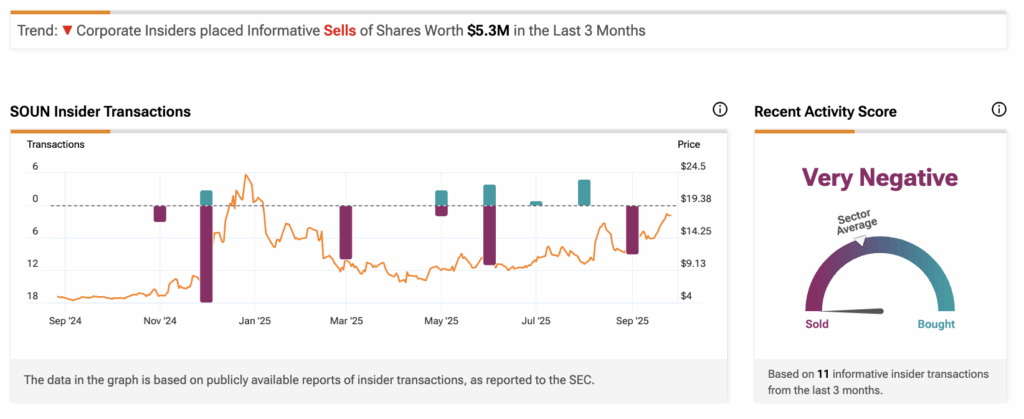

Shares of U.S.-based SoundHound AI (SOUN) fell after key executives sold a significant portion of their Class A stock. The insider sales have raised concerns among investors, prompting a pullback in the company’s share price. SOUN stock has declined by over 7% on Thursday as of this writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Insiders selling shares can sometimes indicate concerns about the company, though personal reasons such as diversification or liquidity needs may also play a role. Investors closely monitor these transactions for signals about management’s confidence and the company’s growth prospects. SoundHound AI’s latest insider sales come after SOUN’s stock has surged more than 60% over the past six months, suggesting that some executives may be taking profits while investors weigh the implications for future performance.

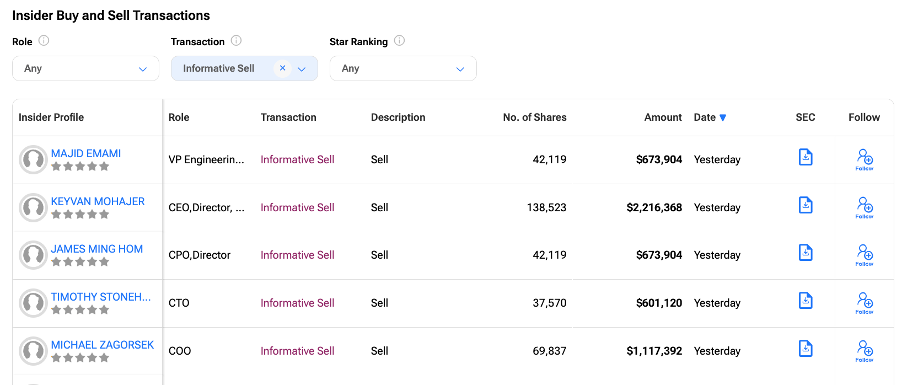

A Detailed Look at SOUN’s Insider Moves

According to Form 4 filings with the SEC on September 22, key executives of SoundHound sold shares in multiple transactions. CEO Keyvan Mohajer led the sales, selling 138,523 shares worth $2.22 million. Meanwhile, COO Michael Zagorsek sold 69,837 shares for $1.12 million, and CTO Timothy Stonehocker sold 37,570 shares valued at $601,120.

Additionally, CPO James Ming Hom and VP of Engineering Majid Emami each sold 42,119 shares, totaling $673,904 per transaction. These moves represent significant stock activity among the company’s top leadership.

Overall, SOUN stock currently shows a Very Negative Insider Confidence Signal on TipRanks, driven by informative sell transactions totaling $5.3 million over the past three months.

Is SOUN Stock a Good Buy?

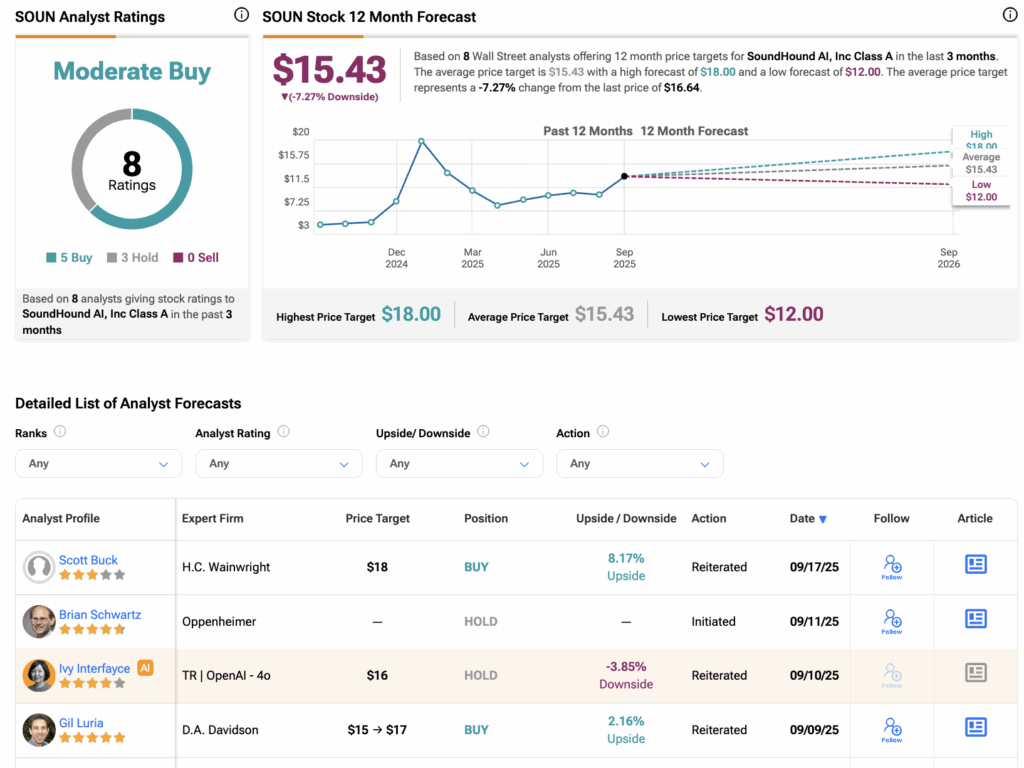

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and three Holds assigned in the last three months. The average SoundHound stock price target is $15.43, suggesting a potential downside of 7.27% from the current level.