Trends often dictate stock market activity, and there’s no doubt which one has had the most impact over the past 18 months or so. Since the rise of ChatGPT, it’s all been about AI, and stocks associated with the game-changing tech have been the driving force behind much of the overall market’s gains.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, while some trends have a faddish element and are destined to fade into obscurity once the hype period is over, that cannot be said regarding the outlook for the AI market. According to Statista, between 2024-2030, the global AI market is anticipated to show a CAGR (compound annual growth rate) of almost 16%, leading to a market volume of $738.80 billion by 2030.

But it’s more than just about dollar size. In fact, assessing its prospects, Nvidia CEO Jensen Huang has gone as far as to say AI will be ‘bigger than the internet.’

He should know. Nvidia, a key provider of AI chips, has seen its shares soar to unprecedented heights driven by investor confidence. But of course, Nvidia has not been the only AI play. Other less lauded names such as SoundHound AI (NASDAQ:SOUN) and Super Micro Computer (NASDAQ:SMCI) have been riding the wave, piling on the gains too. But are these companies the real AI deal or just floating in Nvidia’s slipstream?

Top investor JR Research has been taking their measure, and has come down in favor of one over the other, so let’s take a closer look at the pair and see why. With some assistance from the TipRanks database we can also find out if the Street’s analysts agree with the 5-star investor’s choice.

SoundHound AI

Chip giant Nvidia has certainly been the big AI story, but it has also been partly responsible for the gains accrued by SoundHound AI. Earlier in the year, after it became known that Nvidia has a small stake in the voice recognition specialist, the shares went on one almighty rally, surging by 446% in a little over a month. While the stock has since handed back a big chunk of those gains to the market, it is still up by 144% since the turn of the year.

So, what exactly tickled Nvidia’s fancy? Utilizing state-of-the-art machine learning techniques, SoundHound AI created a powerful platform that excels at precisely identifying songs, music, spoken requests, and even hummed melodies. In 2015, it even become a pioneer in integrating a music recognition service into automobiles, in partnership with Hyundai for its Genesis model. But its AI’s tech is not just reserved for recognizing music; it powers voice-enabled AI assistants and integrates seamlessly into various systems, elevating user experiences across a range of industries, including automotive, restaurants and IoT devices.

In the midst of the stock’s charge, such was the momentum, a mixed Q4 report was causally brushed aside. While revenue grew by a strong 80.5% from the same period a year ago to $17.15 million, the figure slightly missed the Street’s call by $0.6 million. Likewise on the bottom-line, Q4 GAAP EPS of -$0.07 fell short of expectations, by $0.01.

The lack of profitability is one element concerning JR Research, who thinks questions need to be addressed on whether the company can uphold its growth trajectory. Moreover, the shadow of Big Tech might be looming over too.

“I believe investors must consider whether SoundHound’s value proposition can provide a sustainable moat against the incursions of big tech companies,” JR Research said. “These leading players have significant resources to integrate proprietary voice AI systems into their ecosystem. However, SoundHound’s thesis of rapidly expanding its revenue streams across various verticals should mitigate its existential risks, although product stickiness is still not proven. Therefore, assigning SOUN a sustainable moat against more intense competition from other AI companies or big tech could be unrealistic.”

To this end, JR Research rates SOUN shares a Hold (i.e. Neutral). (To watch JR Research’s track record, click here)

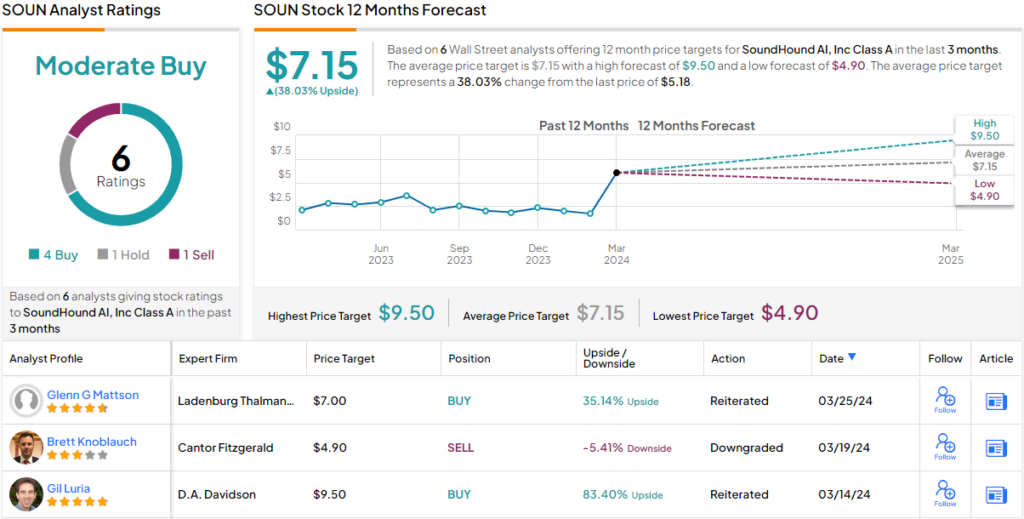

Turning now to Wall Street’s analysts, where the overall take is more upbeat; based on a mix of 4 Buys vs. 1 Hold and Sell, each, the stock claims a Moderate Buy consensus rating. The forecast calls for one-year returns of 38%, considering the average target stands at $7.15. (See SOUN stock forecast)

Super Micro Computer (SMCI)

It’s hard to avoid Nvidia when talking of AI and the semi colossus makes another appearance when the conversation turns to Super Micro Computer. While much has been made of Nvidia’s climb to become the world’s third most valuable company, its past year’s gains are put in the shade by those of SMCI. Even after a recent pullback, the stock has delivered returns of 790% over the trailing 12 months.

But gains dibs aside, the two aren’t actually competitors at all. In fact, they share a mutually beneficial relationship; Supermicro provides advanced server and storage solutions tailored to efficiently handle the demanding tasks typical of AI applications. The firm collaborates with Nvidia, integrating their processors into its hardware framework.

And it is quick at doing so. During Nvidia’s recent GTC event, the semiconductor giant introduced its Blackwell GPU architecture. Shortly after the unveiling, SMCI announced a lineup of complementary AI server products.

The company’s success in grabbing the AI opportunity by the horns was evident in its second quarter of fiscal 2024 report. Revenue more than doubled compared to the prior year and reached $3.66 billion, beating the consensus estimate by $400 million. Additionally, adj. EPS of $5.59 beat the analysts’ forecast by $0.43.

Looking at Supermicro’s success, JR Research has had a big change of heart around the firm, admitting to “having underestimated its near-term AI growth inflection.” And although risks remain, the 5-star investor takes an overall favorable view when assessing the company’s road ahead.

“I believe Supermicro is well-positioned to maintain its leadership ahead of its hardware peers,” JR Research opined. “However, that lead isn’t insurmountable. While Supermicro has gained an advantage in the CSP space, the enterprise space could be more challenging as Supermicro manages more intense competition against the ODMs, which have a strong presence in that vertical. Moreover, the nascent verticals outside of the cloud and data center segments are still developing. It’s an area where Supermicro hasn’t demonstrated dominance, suggesting its leadership is far from secure.”

“However,” JR goes on to say, “developing more powerful AI models could also lead to a surge in medium-term AI rack solutions demanded by the CSPs, even as spending is expected to broaden. As a result, Supermicro could see a more robust revenue growth trajectory over its current $25B target.”

Accordingly, JR Research rates SMCI shares a Buy.

It’s mostly Buys amongst the cadre of Street analysts, too – 7, in total. With the addition of 3 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. That said, considering the pat year’s big returns, the $965.64 average target suggests the stock will stay rangebound for the time being. (See SMCI stock forecast)

And now the verdict is in – according to JR Research’s view, Super Micro Computer is clearly the superior AI stock for investors to buy today.

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.