Two emerging players in the AI space, SoundHound AI (SOUN) and BigBear.ai (BBAI), are gearing up to report their third-quarter 2025 results in early November. Both companies have captured investor attention with their AI-driven technologies and rapid growth potential. As both companies prepare to report their Q3 results, investor sentiment is likely to hinge on earnings performance and guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, SoundHound AI focuses on voice recognition and language processing solutions across industries, while BigBear.ai delivers data-driven intelligence tools mainly for the U.S. defense and government sectors.

What Analysts Expect from SoundHound’s Q3 Earnings

On Wall Street, analysts expect SoundHound to report a Q3 loss of $0.09 per share, wider than the $0.06 loss posted a year ago. However, revenue is forecast to reach $40.49 million, reflecting more than 60% year-over-year growth.

Looking ahead, SoundHound expects full-year revenue to surge 89%–110%, reaching between $160 million and $178 million. The revenue growth reflects rising demand for the company’s voice AI technology and its expanding product portfolio. While the company remains unprofitable, its strong revenue growth and improving outlook suggest promising potential.

Is SOUN Stock a Good Buy?

SOUN shares have soared over 60% in the last six months but remain volatile, highlighting the risks of their rapid rise. The recent rally has brought the stock closer to analysts’ average price targets, limiting near-term upside. However, for long-term investors, SoundHound’s outlook and expanding AI footprint remain compelling. A solid Q3 performance could further lift investor confidence and renew momentum in the stock.

Earlier this month, four-star-rated analyst Scott Buck of H.C. Wainwright raised his price target on SOUN from $18 to a Street-high of $26, citing stronger confidence in the company’s long-term roadmap, even if the stock appears expensive in the near term.

What Analysts Expect from BigBear.ai’s Q3 Earnings

Turning to BigBear.ai, Wall Street expects the company to post a Q3 loss of $0.07 per share, compared to a $0.05 loss in the same quarter last year. Additionally, revenue is forecast to come in at around $31.81 million, marking a year-over-year decline of more than 20%. In the previous quarter, revenue fell 18% year over year to $32.5 million, mainly due to reduced activity in certain Army programs.

The company expects full-year 2025 revenue to range between $125 million and $140 million.

Is Big Bear a Good Stock to Buy?

In contrast to SOUN, BBAI stock has experienced an even steeper rally, soaring 96% over the last six months and rising 50% year-to-date. However, its financial performance continues to trail SoundHound, reflecting weaker growth momentum.

On the positive side, BigBear.ai has a strong foothold in national security and defense, with its AI technology used in U.S. Navy submarine projects and airport facial recognition systems. However, its dependence on federal contracts also brings risks, as political changes or budget cuts could affect future deals.

SOUN or BBAI: Which Stock Offers Higher Upside, According to Analysts?

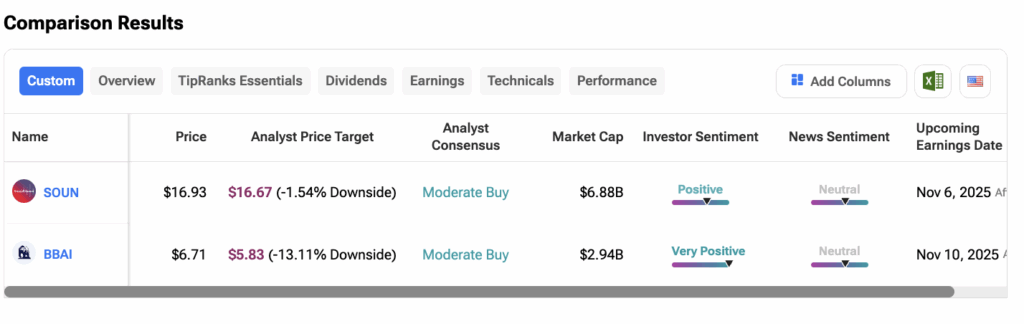

Using TipRanks’ Stock Comparison Tool, we compared SOUN and BBAI to see which small-cap AI stock analysts favor. Both carry a Moderate Buy rating. SOUN stock has a price target of $16.67, implying a downside of 1.5%, while BBAI’s stock price target of $5.83 implies a bigger downside of over 13%.

Conclusion

Both SoundHound and BigBear.ai are drawing investor attention as they vie for leadership in the AI space. SoundHound shines with strong revenue growth and promising long-term potential, while BigBear.ai contends with weaker financials and heavy reliance on government contracts.

In the near term, both stocks remain volatile after sharp gains over the past year. The upcoming Q3 results will be a crucial test for both SOUN and BBAI. Strong performance could reignite momentum and attract growth investors, while mounting losses could weigh on shares.