Soros Fund Management sold shares of chip designer Arm Holdings (NASDAQ:ARM) in Q4, per the latest 13F filing. This implies that the hedge fund missed the recent rally in ARM stock. Notably, ARM stock is up about 68% year-to-date, getting a significant boost from better-than-expected Q3 results on February 7 and Artificial Intelligence (AI)-led growth opportunities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on its closing price of $126.40 on February 14, Arm stock is trading about 147.8% higher than its IPO price of $51.

As it has gained significantly in value, let’s look at the Street’s forecast for ARM stock.

Is ARM Stock a Buy?

Arm delivered adjusted earnings of $0.29 per share on revenues of $824 million in Q3. Analysts expected ARM to post EPS of $0.25 on revenues of $762 million. Further, the company raised its full-year sales and earnings outlook.

Following the company’s solid quarterly performance and robust outlook, J.P. Morgan analyst Harlan Sur raised the price target on ARM stock to $100 from $70 on February 8. Sur expects ARM to deliver 18% annual growth in its top line over the next three years.

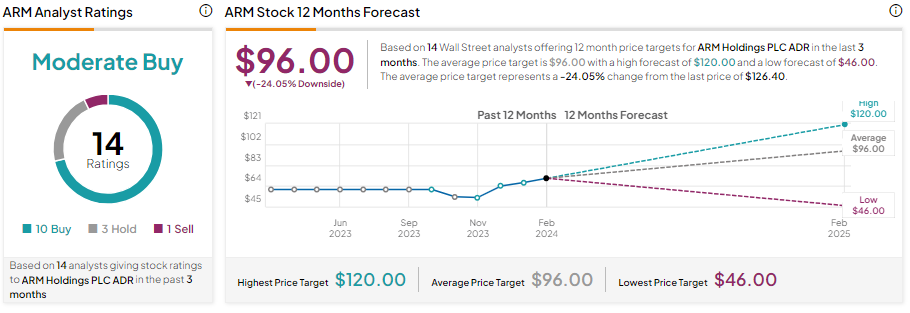

While most analysts maintain a bullish stance on ARM stock, the notable gain in its share price implies that positives are already priced in. It has 10 Buy, three Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $96 implies 24.05% downside potential from current levels.