Sony Group’s (NYSE:SONY) unit Sony Pictures has inked a multi-year deal with Legendary Entertainment to distribute the latter’s movie releases on a global level. Further, Sony will also take care of the home entertainment and TV distribution of those releases.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sony is a Japanese multinational that makes a variety of electronic products. It also provides video games and consoles, music, and movies.

Per the terms of the agreement, Sony’s global reach excludes China, as Legendary East will look after the distribution work in the region. Also, Legendary holds the right to partner with other streaming service providers.

It is worth noting that Legendary has produced many successful releases, both in theatres and on streaming platforms. Some notable names include Dune, Godzilla versus Kong, and Enola Holmes, among others.

Legendary has not yet completely broken ties with its former distributor, Warner Bros. Pictures (NASDAQ:WBD). Warner would continue to handle the distribution of some existing titles, including Dune.

Is Sony a Buy Stock?

Sony remains optimistic about its current fiscal year’s (ending March 2023) results. In the last earnings call, the company raised its guidance for revenue and profit based on expectations of robust performance in its music and movie businesses.

Also, hedge funds are bullish on the stock. Our data shows that hedge funds bought 4.3 million shares of SONY last quarter. Overall, the stock scores a 9 out of 10 on TipRanks’ Smart Score rating system, which indicates that the stock is likely to outperform market averages.

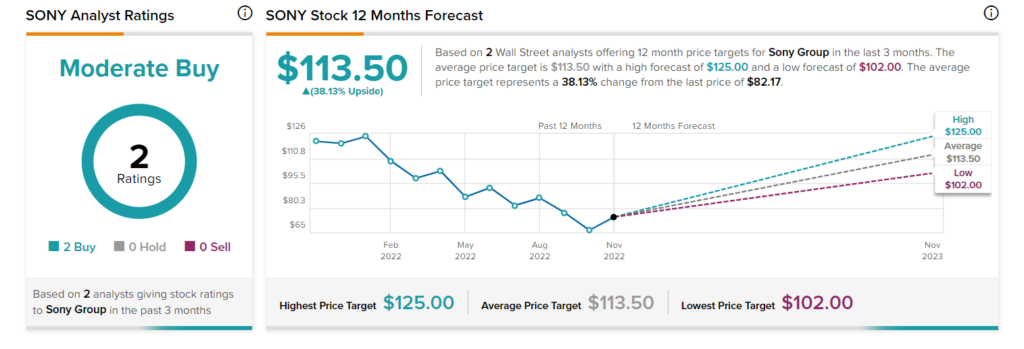

The Street is cautiously optimistic about Sony with a Moderate Buy consensus rating based on two Buys. The average Sony price target of $113.50 implies 38.13% upside potential. Shares have declined about 35% year-to-date.