Some Tesla (TSLA) investors are urging others to vote against a proposed pay package for CEO Elon Musk at the upcoming shareholder meeting on November 6. The package, announced last month, could be worth around $1 trillion. To receive the full amount, Musk would need to raise the EV maker’s market value to $8.5 trillion over the next 10 years and meet major goals, such as earning $400 billion annually, producing a million Optimus robots, and delivering 12 million electric vehicles by 2035. Tesla’s board says that the plan is performance-based, and Musk would earn nothing if he fails to meet these targets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, the investors behind the letter—such as SOC Investment Group, the American Federation of Teachers, and several U.S. state officials—believe that the board hasn’t done enough to hold Musk accountable. Indeed, they say that he has become too distracted by his other companies and hasn’t made a clear commitment to focus on Tesla. They also criticized the board for not stepping in when Musk accepted a leadership role at the U.S. Department of Government Efficiency, which they say hurt Tesla’s image and performance.

The group also argues that the board is too close to Musk personally and professionally, and that the goals in the pay plan aren’t as tough as they seem. In addition, they point to Tesla’s recent struggles as a reason to push back on the proposal. In the first half of 2025, Tesla’s sales fell 13% compared to the same period in 2024. The decline was even worse in Europe, where Tesla’s overall market share for electric vehicles fell from 21.6% to 14.5%. Although third-quarter deliveries rose 7% to 497,099 vehicles, Tesla’s production still slipped year-over-year.

What Is the Prediction for Tesla Stock?

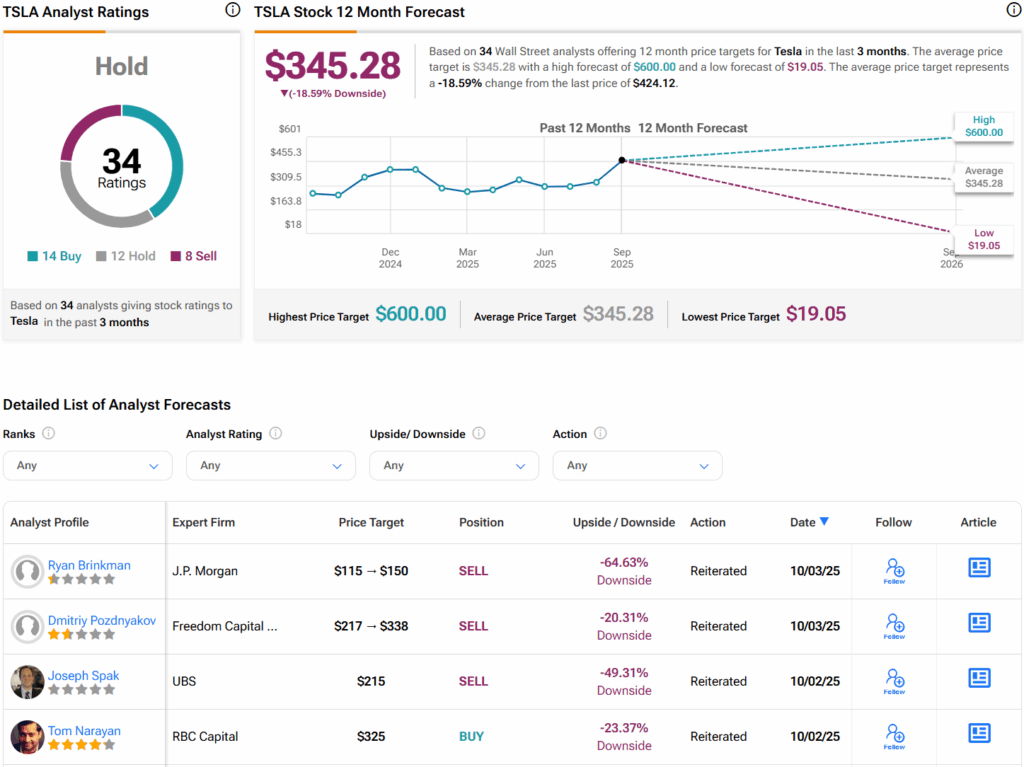

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $345.28 per share implies 18.6% downside risk.